-

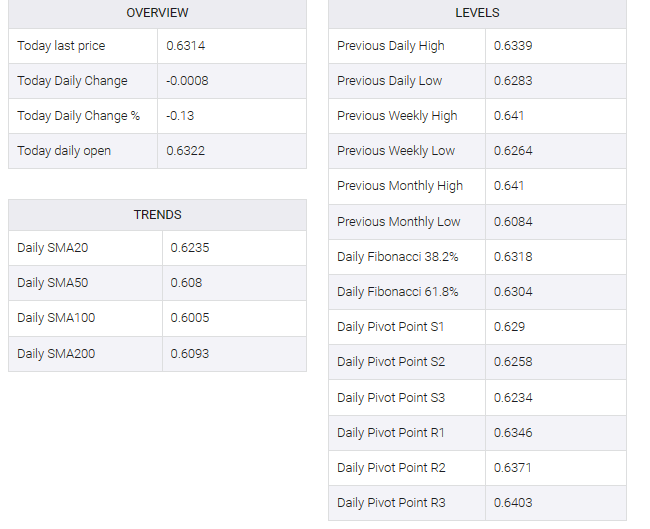

NZD/USD trades on a softer note near 0.6313 on the downbeat Chinese economic data.

-

The Chinese NBS Manufacturing PMI came in at 49.0 in December vs. 49.4 prior, worse than expected.

-

The markets expect that the Fed will begin its easing cycle with a quarter-point drop in March.

-

Market players await December’s Caixin Manufacturing PMI and US S&P Global Manufacturing PMI, due on Tuesday.

The NZD/USD pair edged lower during the Asian trading hours only on Tuesday. Weaker-than-expected Chinese economic data exerted some selling pressure on the New Zealand dollar (NZD). At press time, the pair is trading at 0.6313, having lost 0.13% on the day.

China’s National Bureau of Statistics (NBS) showed on Sunday that the country’s NBS Manufacturing Purchasing Managers’ Index (PMI) fell to 49.0 in December from 49.4 in the previous month, falling short of market estimates of 49.5 in November. Meanwhile, the NBS non-manufacturing PMI came in at 50.4 in December from 50.2 in November, missing expectations of 50.5.

Inflation risks have risen in China, and it needs a big dose of fiscal and monetary stimulus in 2024. Negative developments surrounding the Chinese economy could weigh on the China-proxy New Zealand dollar (NZD) and act as a headwind to the NZD/USD pair.

On the other hand, the pair’s downside could be limited by expectations that the US Federal Reserve (Fed) will cut interest rates in 2024. March, followed by similar cuts in May and June to keep pace with cooling inflation.

Going forward, traders will focus on China’s Caixin Manufacturing PMI for December and the US S&P Global Manufacturing PMI on Tuesday. On Wednesday, attention will shift to the proceedings of the Federal Open Market Committee (FOMC). The highly anticipated US Nonfarm Payrolls (NFP) report will be released on Friday. Losing girls may have a clear direction for the NZD/USD pair.