-

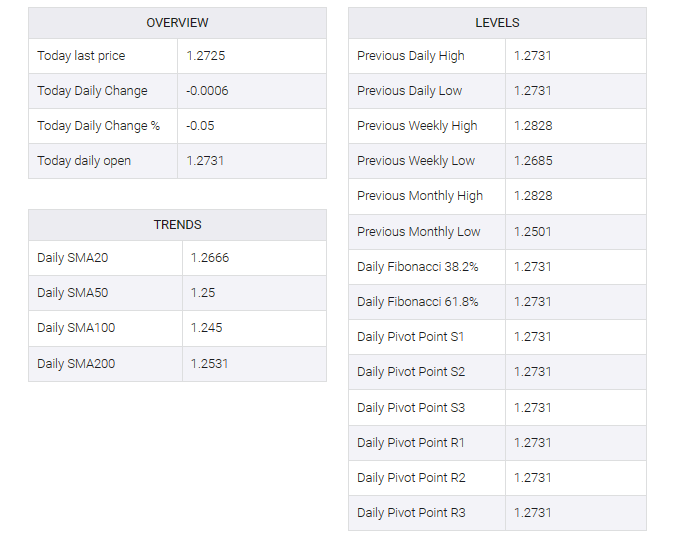

GBP/USD loses ground around 1.2725 in the first trading day of 2024.

-

The markets are pricing in 88% possibility of rate cuts in March, according to the CME Group’s FedWatch tool.

-

Investors are pricing as many as six quarter-point rate cuts from the Bank of England (BoE) during 2024.

-

UK S&P Global/CIPS Manufacturing PMI and US S&P Global Manufacturing PMI reports will be released later on Tuesday.

The GBP/USD pair posts modest losses during the early Asian session on Tuesday. The modest rebound in the US Dollar (USD) lends some support to the major pair. At press time, GBP/USD is trading near 1.2725, down 0.04% for the day.

After the US Federal Reserve’s (Fed) final meeting of the year earlier in December, Fed officials held rates steady for the third straight month and signaled a series of interest rate cuts in 2024 as inflation eases faster than estimated. Traders are betting on aggressive rate cuts, starting as early as March. The markets are pricing in 88% odds rate cuts in March, according to the CME Group’s FedWatch tool.

Data released on Friday revealed that the US Chicago Purchasing Managers’ Index (PMI) rose to 46.9 in December from 55.8 in November, weaker than estimates of 51.0. Market players will take further cues from Friday’s US Nonfarm Payrolls (NFP). The figure is projected to show an increase of 163K in December compared to 199K previously.

On the British pound, the Bank of England (BoE) said it was premature to talk about a rate cut. However, investors have cut rates by as much as six quarter-points in 2024. The next BoE monetary policy meeting will be on 1 February.

Later on Tuesday, the UK S&P Global/CIPS Manufacturing PMI for December will be released. Also, the US S&P Global Manufacturing PMI will factor in. This week’s highlight will be the Federal Open Market Committee (FOMC) minutes on Wednesday and US employment data for December, including US nonfarm payrolls, the unemployment rate, and average hourly earnings, on Friday.