-

AUD/USD hovers around 0.6700 amid the USD weakness.

-

Fed’s Williams said financial markets continue to be highly sensitive to new data.

-

The Australian monthly CPI eased to the lowest rate since January 2022.

-

Australian Trade Balance and US CPI will be in the spotlight on Thursday.

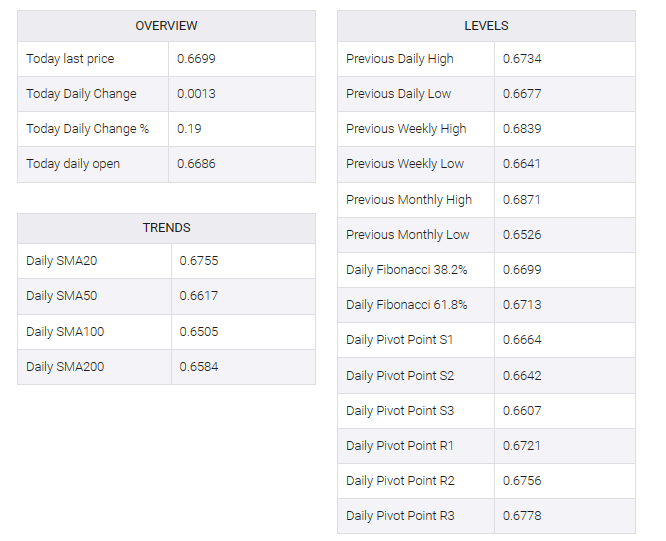

The AUD/USD pair extended the range-bound theme near the 0.6700 mark at the start of the Asian session on Thursday. Investors await the release of the Australian trade balance report on Thursday ahead of US inflation data as measured by the Consumer Price Index (CPI). AUD/USD is currently trading near 0.6699, up 0.04% on the day.

A lack of economic data on Wednesday prompted financial markets to look to interest rate cuts that central banks have already priced in for the current year. Nevertheless, the US CPI on Thursday could cause market volatility. Markets had estimated a rise of 0.2% MoM in headline inflation and 0.3% MoM in the core figure.

Investors placed their bets on five rate cuts in 2024, dismissing the Fed’s forecast of only 75 bps of easing. On Thursday, New York Federal Reserve (Fed) President John Williams said financial markets are going to be highly sensitive to new data. Williams added that the Fed is in a good place and it’s time to consider the future of interest rates. The Fed will eventually be forced back to neutral policy levels.

The Australian Bureau of Statistics revealed on Wednesday that the country’s monthly CPI fell to 4.3% YoY in November from a previous reading of 4.9%, the lowest rate since January 2022. These figures support the view that the cash rate will remain unchanged at its February meeting

Looking ahead, market participants will monitor the Australian Trade Balance on Thursday, which is projected to see a trade surplus of 7,500M. On the US docket, the US CPI report and weekly Initial Jobless Claims will be released.