-

USD/CAD drifts lower for the second straight day and is pressured by a combination of factors.

-

An uptick in Oil prices underpins the Loonie and weighs on the pair amid subdued USD demand.

-

The downside potential seems limited as traders keenly await the release of the US CPI report.

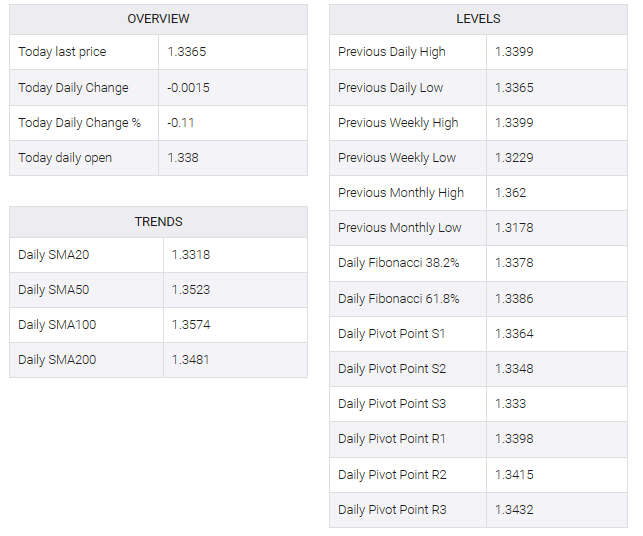

The USD/CAD pair remains under some selling pressure for the second straight day on Thursday and moves further away from a nearly four-week high, around the 1.3415 region touched on Tuesday. Spot prices currently trade around the 1.3365-1.3360 area, down just over 0.10% for the day, as traders now look to the latest US consumer inflation figures for a fresh impetus.

The important US CPI report will influence future policy decisions by the Federal Reserve (Fed), which, in turn, should drive demand for the USD dollar (USD) and provide a new directional impetus to the USD/CAD pair. US key data headed for risks amid uncertainty over when the US central bank will start cutting interest rates, with the buck extending its consolidating price movement and bounding into a week-old trading range. Apart from this, a positive risk tone is seen as another factor eroding the greenback’s relative safe haven status and putting some pressure on the currency pair.

Meanwhile, rising crude oil prices are seen underpinning the commodity-linked loonie and contributing to the suggested tone around the USD/CAD pair. That said, any meaningful upside for the black liquid, however, appears elusive given the bearish fundamental backdrop. Wednesday’s Energy Information Administration (EIA) report showed that an unexpected weekly build in US inventories added to fears that global oil consumption will decline in 2024. This, to a greater extent, alleviates concerns about potential disruptions in Middle Eastern supplies and should act as such. A headwind for oil prices.

In addition, the easing of odds for more aggressive policy easing by the Fed, which supports higher US Treasury bond yields, favors USD bulls and contributes to limiting losses for the USD/CAD pair. Hence, it would be wise to wait for a strong follow-through sell-off before confirming a recent strong recovery move from the 1.3175 region or a multi-month low hit in late December and positioning for any further losses.