-

NZD/USD retraces its gains on risk-averse sentiment due to the Middle East situation.

-

Softer US PPI data boosted the market sentiment toward the Fed rate cut.

-

Chinese inflation remains in deflationary territory, keeping the antipodean currencies, including the New Zealand Dollar (NZD).

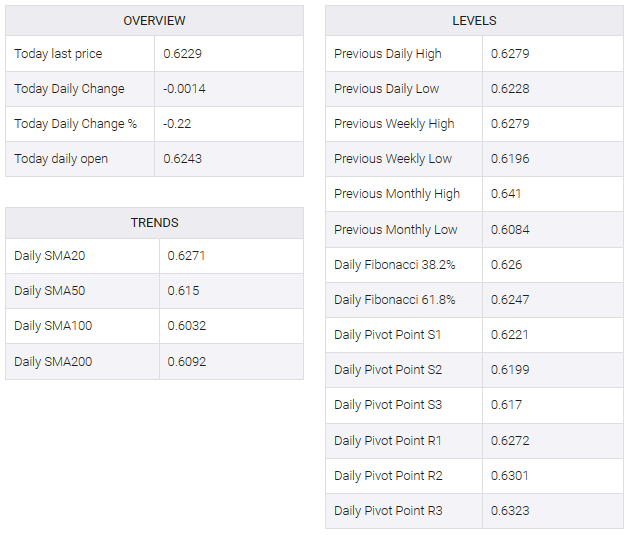

NZD/USD snapped its two-day winning streak as market sentiment shifted to risk-averse amid heightened geopolitical tensions in the Middle East. The NZD/USD pair traded near 0.6230 during the Asian session on Monday. However, soft producer price index (PPI) data bolstered market sentiment on the likelihood of the Federal Reserve (Fed) starting to ease monetary policy. This sentiment contributed to weakening US bond yields, subsequently putting downward pressure on the US dollar (USD).

The Iranian-led Houthis fired an anti-ship cruise missile at the USS Laboon in the Red Sea on Monday. This development has contributed to support for the greenback, a safe-haven currency at a time of heightened geopolitical uncertainty.

According to the US Bureau of Labor Statistics, December’s producer price index (PPI) figure was 1.0% year-on-year, beating the previous reading of 0.8%. Core PPI reached 1.8% on the year, down from 2.0% in November. The monthly headline and core PPI indices remained at 0.1% decline and 0.0% respectively. These figures indicate a less robust inflationary environment, which affects the perception of possible monetary policy easing by the Federal Reserve and the US dollar.

On the New Zealand Dollar (NZD) front, with the absence of high-impact data during the last week, Chinese data was released on Friday. China’s Consumer Price Index (YoY) remained in deflationary territory for the third consecutive month in December.

Additionally, the Chinese Producer Price Index (PPI) experienced a decline for the 15th consecutive month. These developments fuel speculations about the potential for additional government stimulus and provide a modest lift to antipodean currencies, including the New Zealand Dollar (NZD). NZIER Business Confidence and GDT Price Index are scheduled to be released on Friday.