-

USD/JPY gains ground on improved US Dollar.

-

Risk-averse sentiment contributes support to strengthening the Greenback

-

BOJ is expected to maintain its inflation projection near 2.0% target in the coming years.

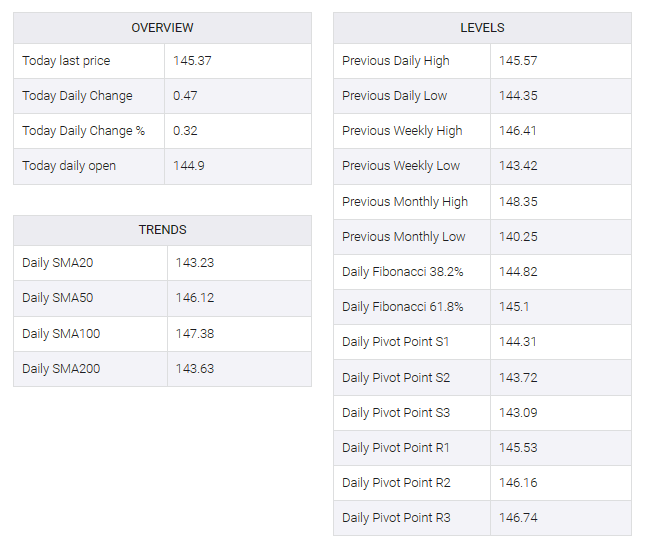

USD/JPY trades higher after registering two days of losses. The USD/JPY pair hovered around 145.40 in the early European session on Monday. The US dollar index (DXY) recovered its intraday losses, trading near 102.40 at the time of writing. However, the US Federal Reserve (Fed) is expected to cut interest rates by 25 basis points at its March meeting, putting downward pressure on the US dollar.

Moreover, the greenback also faces a challenge in the fall in US Treasury yields, which can be attributed to weaker-than-expected producer price index (PPI) data from the United States (US). The 2-year and 10-year yields on US bond coupons were down 4.14% and 3.94%, respectively, as of press time.

The Bank of Japan released Money Supply M2+CD (YoY) for December, which was unchanged at 2.3%. Machine tool orders (YoY) declined 9.9% from the previous decline of 13.6% respectively. Moreover, Japan’s two-year yield fell below zero for the first time since July 2023.

On Friday, reports indicated that the Bank of Japan (BOJ) may cut its core inflation forecast for fiscal 2024 due to the recent fall in oil prices. Despite global economic uncertainty and lower spending, the BOJ will maintain its estimate that trend inflation will remain close to its 2.0% target in the coming years. This updated forecast will be included in the bank’s quarterly outlook report scheduled for its upcoming January meeting. It is widely expected that the BOJ will keep its ultra-loose policy settings unchanged at this policy meeting.

Japan’s Consumer Price Index (CPI) data will be observed on Friday by the traders. On the US docket, traders will likely observe the Retail Sales data on Wednesday and housing data on Thursday.