-

The Aussie is under increasing bearish pressure after breaching 0.6660 support.

-

Dwindling hopes of rate cuts and geopolitical tensions are boosting the US Dollar.

-

Fed speakers, US Retail Sales and a string of data from China will set the pair’s near-term direction.

The risk-sensitive Aussie was one of the worst performers on Tuesday, succumbing to the strength of the US dollar. Hokey comments from ECB policymakers and growing uncertainty in the Red Sea forced traders to reassess their rate cut expectations, boosting the US dollar against most of its rivals.

In Australia, recent data showed that consumer confidence deteriorated in January, adding to the negative pressure on Australia.

Today’s focus is the US NY Fed Empire State Manufacturing Index and the Fed’s Waller, a traditional hawkish speech. The highlight of the week, however, will be Wednesday’s US retail sales data.

Also on Wednesday, a flurry of economic data from China could have a significant impact on Australia, with Q4 GDP and December retail sales of particular interest.

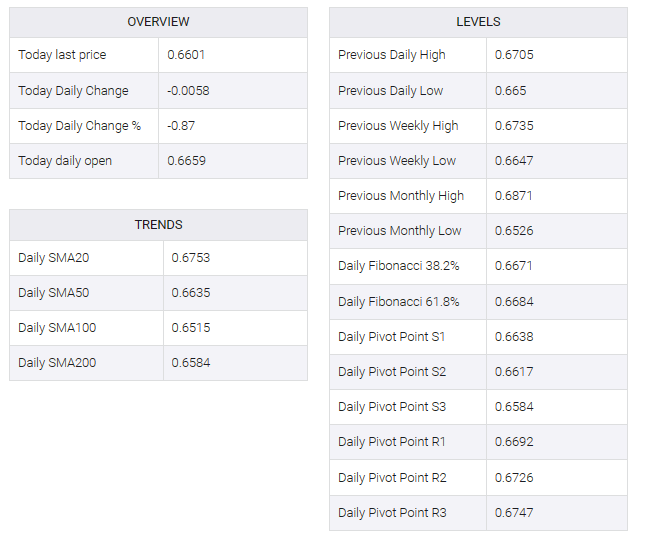

Technical analysis shows that the pair is under increasing bearish pressure after breaching the 0.6660 support area. Next downside targets are 0.6540 and 0.6520. Resistance is the aforementioned 0.6660 and 0.6735.