The the NASDAQ Composite has slid dramatically since the beginning of 2022, falling almost 13 percent. However, don’t count on the index to return to record levels in the near future. The index is fighting on two fronts: rising rates and declining earnings estimates.

This means that the NASDAQ might be struggling to establish its foundations in the coming six months.

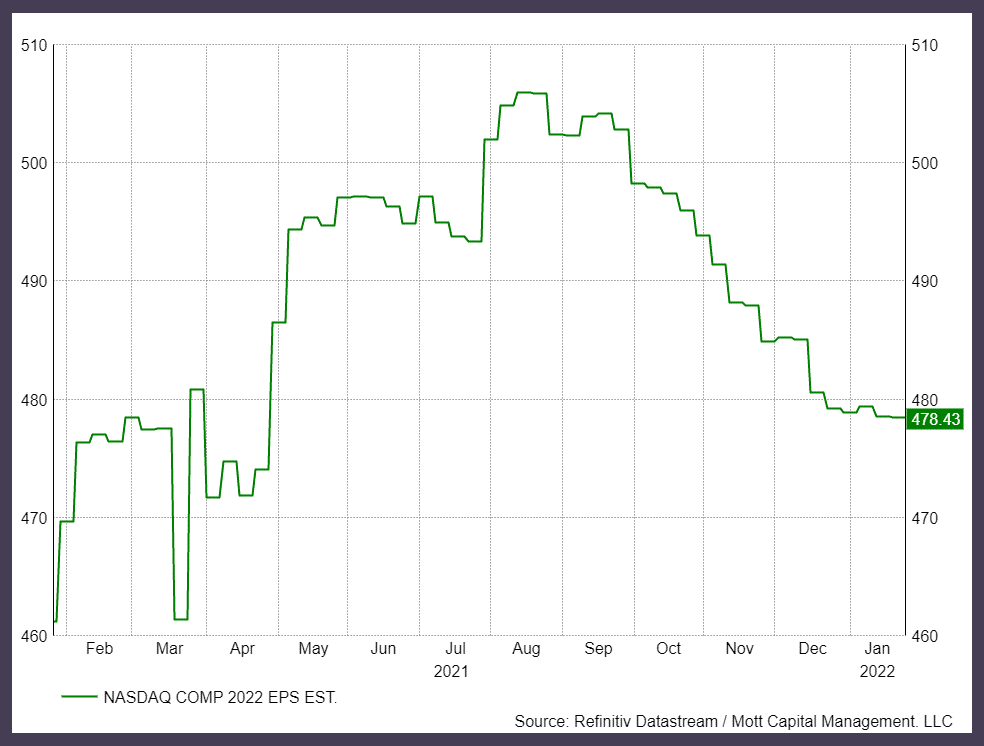

Estimates of earnings for NASDAQ have fallen by $478.43 per share in 2022, a drop of 5.5 percent from a high of $505.83 on August. 25. The drop in estimates for earnings is significant because increasing real yields will decrease the ratio of PE for the index. If you combine the lower PE ratio and declining estimations of earnings could limit potential gains the index could make.

A Lower PE Ratio

Even if NASDAQ Composite saw its PE ratio increase to its high in December of 33.1 The worth of the Index could increase to 15,835. This is close to the intraday peak of 16,212 from November, but nearly 2.5 percentage points lower. It will require an even higher ratio of PE to exceed those previous highs for the NASDAQ.

This could be a challenge to accomplish, since the real yields are rising rapidly which could increase the yield on earnings of the NASDAQ higher, and the PE ratio down. The 5-year TIP rate has increased dramatically in 2022, increasing to around -1.05 percentage from -1.64 percent at the 31st of December. 31.

In the same period the yield on earnings of that NASDAQ Composite has risen to 3.49 percent from 3.06 percent, based on 2022’s EPS estimates. The higher the actual yield and the higher the probability is that the yields from the stock market will grow too.

The yield on earnings is the reverse of the ratio PE, and so when the earnings yield increases in value, the PE ratio declines. The issue is that the real 5-year yield is beginning to break out, and in the event that the Fed remains as aggressive as it appears, the breakout could cause 5 years of TIP to increase to about 50 percent.

This would boost the earnings yield of the NASDAQ up even more, possibly by 60 bps more up to around 4 percent. This would translate to an PE ratio of 25. Based on the 2022 estimates for earnings of $478.43 that would put the value of an NASDAQ Composite at 11,960, which is a decrease of 13 percent.

This all depends on the extent to which real yields increase. However, the expectation is that the Fed to begin increasing rate in the month of March. A significant market decline is likely to take place in the coming months as the market prices reflect the tighter monetary policy and increased rates.

Valuations Will Matter Again

However, certain stocks are likely to do better in this regard than others. Particularly those which have experienced more significant gains and have acceptable valuations.

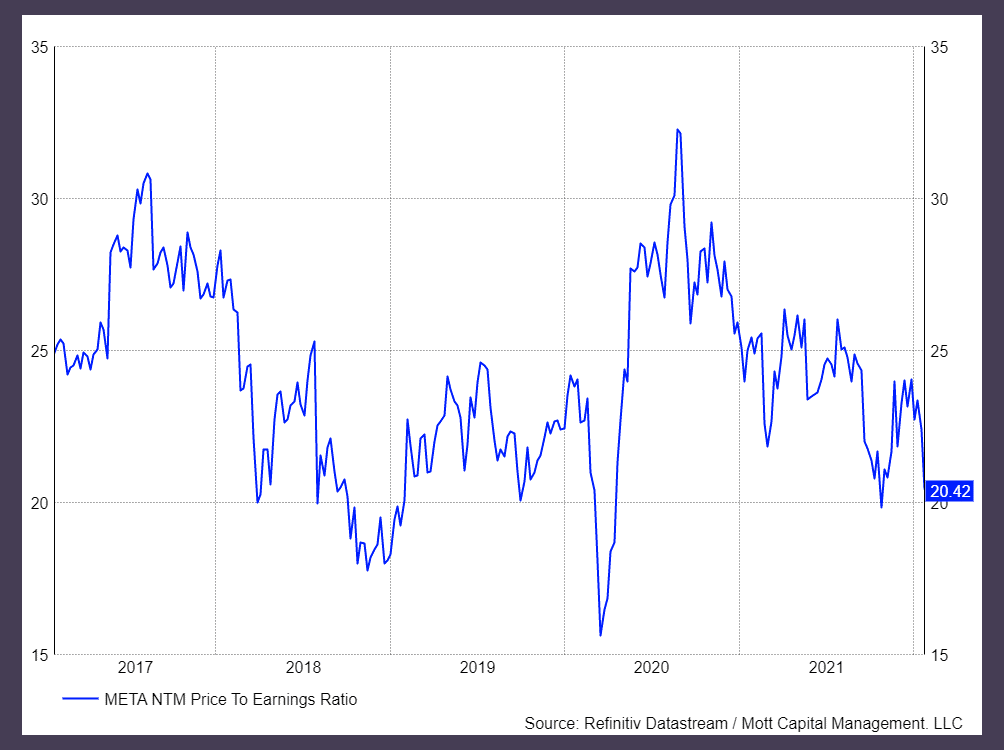

A stock such as Meta Platforms (NASDAQ: FB) has seen an incredible rise over the past two years however, it has also experienced significant growth in earnings. The price is just 21 times its twelve-month earnings expectations on a historical basis. Although the stock is likely to slide during a larger market decline, the less valuation could indicate where investors are able to see an opportunity in Meta which could help support the stock.

However stocks such as Shopify (NYSE: SHOP) could face an uphill climb. The stock has fallen significantly, yet the shares are trading at 15.6 times the next twelve month’s estimates for sales, and generally, it trades between 9-12 times sales. This suggests that there may be a downside to the stock in the event of a wider market selling-off.

If interest rates increase from now and the equity market’s growth has come after lower rates, it is to be only natural for the market to adjust and adapt to these adjustments. It is possible for earnings to decline which means that valuations will be important in the future.