The Pandemic Boom Goes Bust

The great financial hangover.

In the past 18 months over the last 18 months, in the past 18 months the U.S. economy enjoyed the most powerful stimulus ever. A staggering $5 trillion in loans were directly in the wallets of the consumers and companies. This triggered a frenzied consumption that was unprecedented in scale. Americans purchased so much and clogged both supply chains.

However, there’s a reason behind why stimulants are often compared to using drugs. It can give you a short-term feeling of high that is and then a terrible hangover. This is exactly what’s expected in 2022, when it becomes clear that the U.S. economy faces an enormous mean-reversion to consumption:

We’ve all been taught from an early age that there’s not any free lunch. This is also true for economic policies. Sure, we triggered huge growth by putting trillions of dollars borrowed into the economy in the past one year… But what is the long-term price?

The Inflation Bill Comes Due

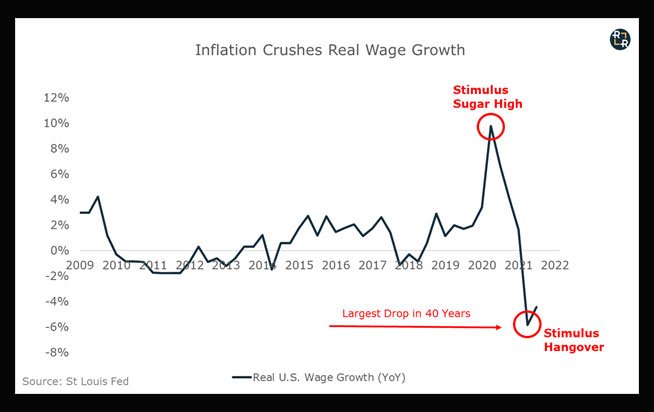

The price of the stimulus plan of yesterday is beginning to show through in the form of increased prices throughout the country. As inflation is at highs of 40 years, averaging 7percent The price of life is increasing more quickly than the income. After experiencing a short-lived rise in inflation-adjusted earnings, they have been reversing course, with recent declines to the lowest level in more than 40 years:

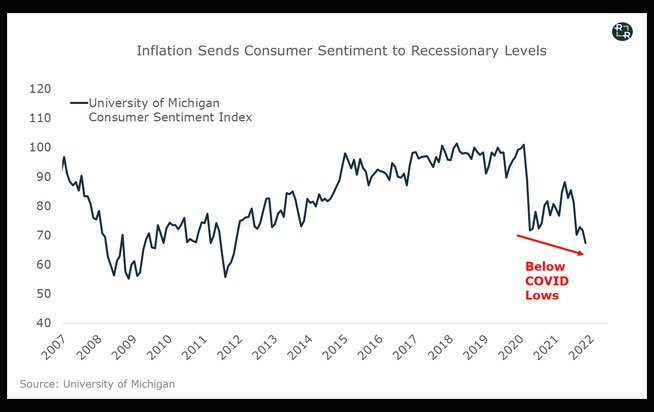

It’s not surprising that U.S. politicians are panicking, blaming “greedy corporations” for the current rise in prices. They’re aware that the chart of the crashing sentiment of consumers that is currently below COVID’s lows, could spell an end to their chances to win re-election

Naturally, companies did not suddenly awaken and get greedy in 2021. The rising costs are the expected and normal result of conjuring billions of dollars and dumping it into the economy.

As the years go by, more Americans are becoming aware of this reality. In the near future, voters will ask themselves: What’s the purpose of all this stimulus when it’s only making us less wealthy? We’re already seeing a backlash from politicians such as senator Joe Manchin, refusing to support the reckless spending on debt-financed stimulus. The rejection of an even more reckless financial stimulus plan is better to ensure the health of our economy and our country. Like withdrawing from any substance in the beginning, the withdrawal of stimulus can cause a lot of suffering in the short term.

The inflationary backlash is forcing to force the U.S. Federal Reserve into tightening its monetary policy and we’re already seeing first indicators of a slowing economy . an unfavorable combination for risky assets of all kinds.

Weak Manufacturing and Retail Sales Data Indicates a Slowing U.S. Economy

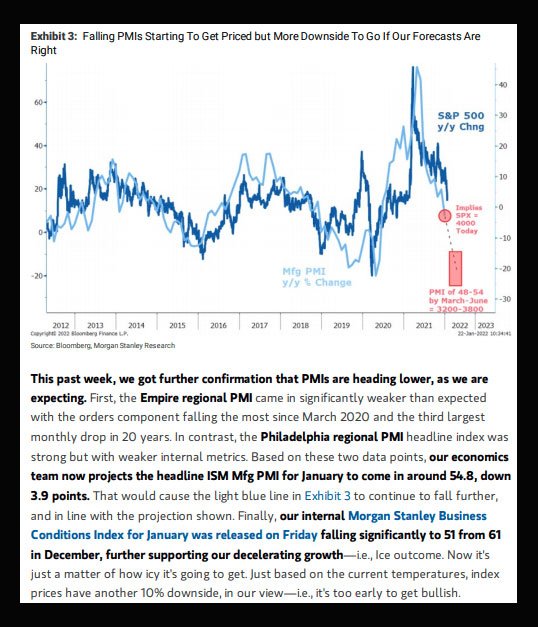

The image below taken from Morgan Stanley research details the ever-growing evidence of that there is a significant slowdown in U.S. manufacturing sector:

In the meantime, the decline in consumer confidence and real wage inflation can be seen in figures on sales at the retail store. In December consumer sentiment in the U.S. consumer posted a -2.3 percent decrease in sales at retail in an inflation-adjusted manner. This is the largest retail sales decrease ever since the Global Financial Crisis. In real terms, disposable incomes in the U.S. is now tracking lower than the trend pre-COVID. That is…

The U.S. consumer has given back all the temporary income gains resulting from stimulus as well as more.

That’s the way of the stimulus that is financed by debt. In the end, we did not create wealth. We simply pulled ahead into the past. The future is here.

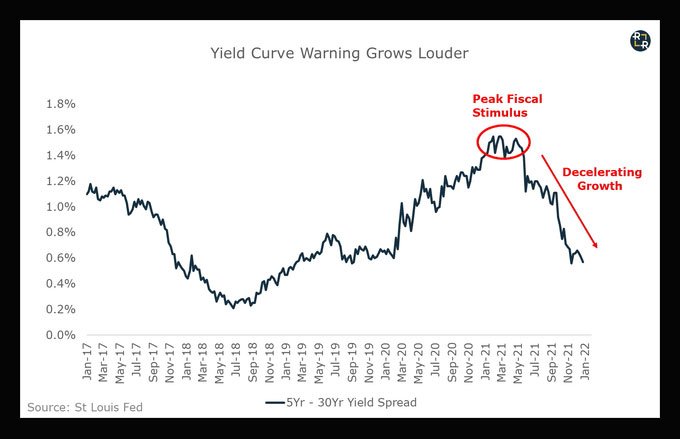

The markets for financial instruments have been sending out warning signs of the coming fiscal cliff for several months. The bond market the difference between long and short duration Treasuries which is an important indicator of the growth outlook for the future suggests it is likely that U.S. economic growth entered in a steady decline after having reached its highest with the most recent round of stimulus tests in the first quarter of 2021:

The market has been emitting its own signals of warning, by bringing on a flurry of prominent single stock explosions. The latest calamity is from the fitness equipment manufacturer Peloton Interactive (NASDAQ:

PTON

).

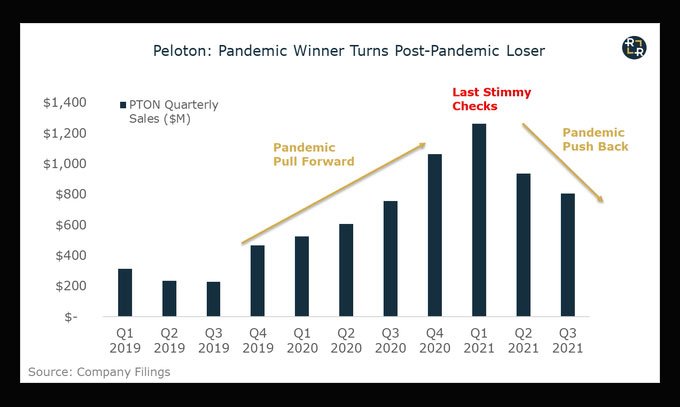

Peloton Shows the Pandemic Pull Forward is Over

The previous Wednesday, Peloton stock fell by 25 percent after the company announced the end of production for its treadmills and bikes, due to lower than anticipated demand.

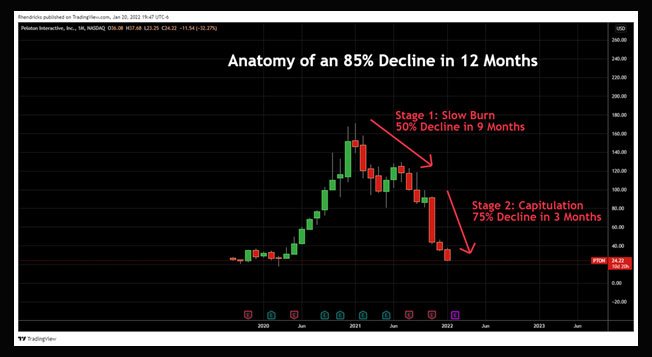

The price drop is the culmination of an 88% share price wipeout in the past twelve months.

There numerous warning signs that anyone who was willing to pay attention. One of the most obvious red flags was the recent share-sales rampage among corporate insiders who sold $500 million worth of Peloton shares in the days prior to the collapse on Thursday.

They were apparently aware of what we know today the result of Peloton’s stimulus funds and stay-at-home purchases in 2020 were a once-in-a-lifetime boost that simply pushed forward a significant portion of new demand for the future into a twelve-month sales explosion.

In Q2 of 2021 the huge pull-forward of pandemics in Peloton demand started to slow. The growth again peaked at the time of the last stimulus checks which were released in Q1 2021.

The issue with the price of shares in the pandemic winners such as Peloton, Zoom (NASDAQ: ZM), DocuSign (NASDAQ: DOCU) and many more is that the Mr. Market spewed a single demand spike into the future indefinitely.

At its height, Peloton commanded a ludicrous $50 billion valuation, which reflected an increase in sales of 10x. The storyline followed the price of shares up because Wall Street conjured fantastic notions of the company making profits that were software-like with an essentially unlimited market (total potential market) to expand to.

Naturally, following an 85percent decline in its share price the whole thing seems evident. Peloton is simply a commoditized low-margin manufacturer of hardware with no moat, and no limit in its growth potential. In the initial nine months following the realisation, the price of its shares was a slow-burning result of clever money selling to dip buyers. The slow burn period was later followed by three months complete capitulation

Peloton is a fantastic example of the magnitude and speed of destruction to wealth that is possible when false Wall Street narratives born from an obsession with money meet realities in the aftermath of the bust.

Do we know of other companies that are well-known for selling low-marginand commoditized hardware productsthat boast a delusional software-like value of more than 10x sales? Stocks that have significant exposure to the upcoming mean reversion of consumer demand and where insiders recently sold billions of dollars worth of the stock?

Oh, right – Tesla (NASDAQ:TSLA).

Tesla – the Next 90% Share Price Wipeout Candidate

Tesla announced a soaring number all over the board in its most recent Fourth quarter report on earnings released on Wednesday. It beat earnings and sales. However, take note of the stock’s reaction dropping over 11% in the next day.

The primary reason to the problem was the fact that Tesla has no plans to launch any new models before 2022. This is a major issue for a company that is priced as if it’s going to become the dominant player in the global automobile market, a daunting task when you only have four vehicle models. It’s the way of life with the markets when it’s priced to excellence.

Take a look at this…

From 2019 through 2021, Tesla’s revenues approximately doubled from about $50 billion to around $100 billion. Over the same time Tesla’s valuation grew by $50 billion, to $1 trillion. This is an auto company that trades at a sales multiple of 10x.

Do I need to say more?

The stock is valued according to the assumption that it will be able to be able to take over the entire world automotive market. Any indication that this bull scenario is not in the cards, and the stock will be re-rated to match your typical car manufacturer and trading at a lower than 1x the sales number (i.e. 90% lower).

Sure, recognize that the bulls come up with numerous elaborate arguments to explain why Tesla should be treated as a world-class software company with 80percent profit margins and unending growth potential. However, that’s the main reason behind the Peloton example . These are the tales that are made up to justify price movements during the manias.

My view is that the only things that truly are relevant to Tesla’s share price is crowd psychology price momentum, crowd psychology and cash flows. The betting here boils into one simple question is whether the current mania has more space to run and is the company about collapse?

For Tesla investors, the indications suggest that the company will fail in 2022.

Peak Money Flows = Peak Mania

In the past, I discussed the trillions of fiscal stimulus dollars fueled records U.S. goods consumption over the last 18 months and how this could be a huge issue when the mean return hits next year.

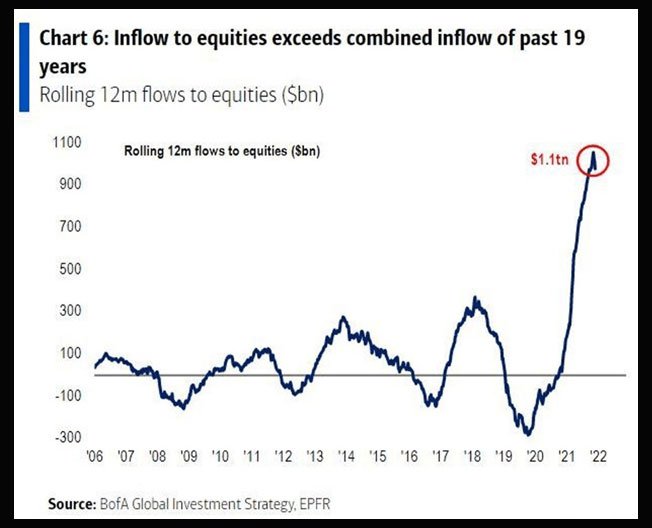

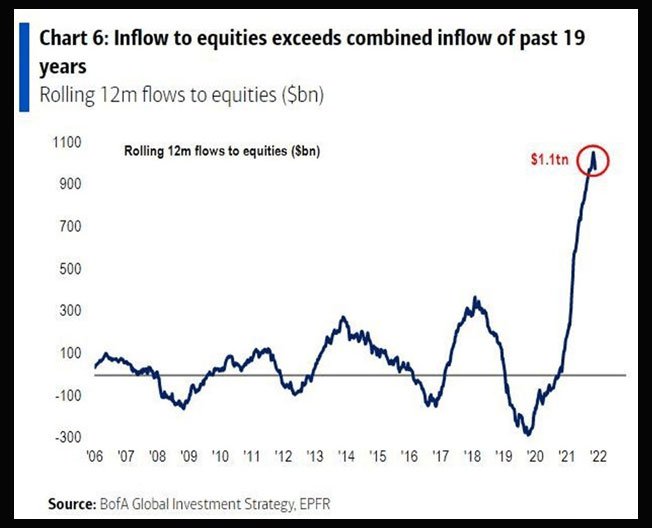

There was a second important area that dollars from the fiscal stimulus program went into: the financial market. The graph below illustrates how the flow of funds towards the U.S. stock market last year was more than the total of the last 19 months… all together:

As we’re beginning to see in the actual economy, I think we’ll see the same reverse in the flow of money in 2022. This is what the graph above suggests could have already started.

Tesla was among the principal recipients of the graph above. Perhaps in one of the most impressive market timing feats of all time, Tesla entered into the S&P 500 in December of 2020, just as the record-setting liquidity tsunami hit the U.S. financial markets.

However, now that the taps for fiscal stimulus shut off, the flow of money has reached their peak and have begun to reverse. It’s not a surprise that the general market for stocks, as well as Tesla has stopped moving straight up and has become more volatile in recent days.

Beyond stock market inflows Tesla shares also profited from the most speculative option market ever.

I (along with numerous others) have explained in detail how soaring call options can cause an “gamma squeeze”, which results in artificial pressure to buy from option dealers who hedge their gamma exposures within the share price ( see more here).

To cut a long tale short I believe Tesla profited from the huge quantity of stocks needed by option brokers to cover their risks as the volume of monthly calls increased by 1.5 million during September 2019 to more than 40 million contracts by the end of the month of November in 2021.

This call option frenzy is result of a volatile market. When the tide of liquidity begins to recede in a market where booms turn to busts, Tesla shares could face an enormous unwinding of the biggest ever gamma squeeze. We might have seen the beginning of this process, as Tesla shares peaking exactly with the top of call option volume in the month of November 2021.

Keep an eye out for news, as this could be an important part of the puzzle, not only in relation to Tesla share prices, but also for the financial markets in general in the future.

Here’s the main point: anyone considering Tesla’s business fundamentals as the primary driver of the price of the shares will be more confused by 2022. The fundamentals may remain improving for Tesla and the price of its shares could decline by 90% in value as the speculation flows reverse.

In the end, it’s not only the stories of stocks like Tesla and Peloton that are at risk in the current market. We’re beginning to see selling pressure hitting the market’s former generals – the FANNGs , a huge warning signal for the current bull market.

Market Generals Starting to Drop

One of the primary indicators of a market’s shift into a bust or boom is the sharp decline in the most speculative stocks. The year of 2008 was a perfect example since the market’s most high-risk cash-burning firms such as the recent series of low-quality IPOs SPACs, IPOs and almost every single holding within the ARK Innovation ETF (NYSE: ARKK) that – changed to market leaders by 2020, and then to market laggards by 2021.

Jeremy Grantham describes this late cycle event as “confidence termites” eating away on the outside part of the bear market before moving through the foundation. Through the majority of 2021, investors was shifted away from these speculative stocks to megacap blue chip leaders, including The FAANNG+ (Facebook (NASDAQ:FB), Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Netflix (NASDAQ:NFLX), Nvidia (NASDAQ:NVDA), Alphabet (NASDAQ:GOOGL) and many more.) stocks.

However, here’s the alarming indicator for bulls – the termites of confidence have entered the mega cap market’s former generals, beginning with Netflix.

The company issued a weak outlook for the future of subscription growth in its most recent earnings report, Netflix dropped by more than 20% in one day. Netflix is currently at a loss of more than 50% from the peak that it set in November 2021.

In the past few weeks, we’ve noticed the selling pressure build up in some of the majors. Particularly, shares of the stalwart Amazon have dropped 25 percent from their previous highs and this is despite no important fundamentals that are actually meaningful.

Take all of it together Take it all together, and both macroeconomic fundamentals, flows of money and momentum in the present market should offer investors ample cause for caution in the coming months. The fiscal hangover as well as the rising inflation will continue to pressurize consumer spending in the actual economy. We’ll probably be witnessing a shift in record-setting flows of cash that helped to boost the hyperspheric valuations on the market today.

Already, we’re seeing the beginning signs of the growth turning to recession even before the Fed is expected to begin tightening the monetary policy to slow down the economy. This will result in less growth in earnings and a slower economy with lower values.

The lesson to take away is don’t expect 2022 to look like 2021 or 2020.

The article was first published in The Ross Report.