-

USD/CHF may show further weakness as the Fed is expected to stick with a 75 bps rate hike.

-

US Durable Goods orders are seen lower at -0.2%, which may slip core CPI further.

-

In addition to Fed policy and US durable goods, Swiss real retail sales will be crucial.

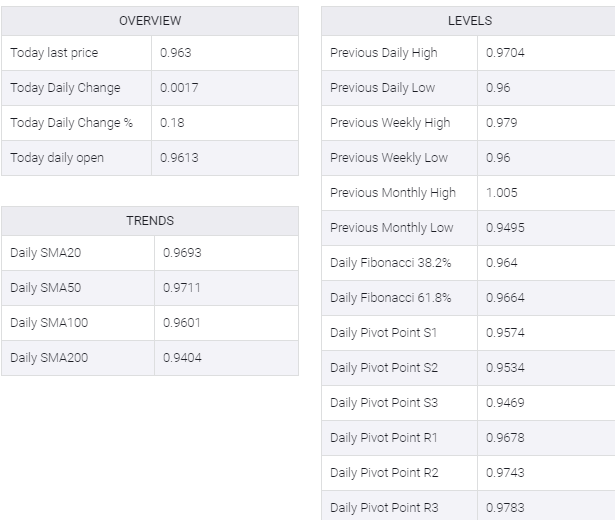

The USD/CHF pair has faced barricades of around 0.9640 in the Asian session after a firmer upside in the initial hours of the trading session. The asset has remained in the grip of bears for the past week and is expected to slide further as the US dollar index (DXY) has remained vulnerable after the display of the long-run inflation expectations.

The release of the inflation expectations at 2.8% vs. the prior release of 3.1% has trimmed the expectations of 100 basis points (bps) interest rate hike by the Federal Reserve (Fed). However, expectations of more policy tightening measures are solid and a rate hike by 75 bps looks imminent. The leading indicators of inflation such as the overall inflation rate and core Consumer Price Index (CPI) have no signs of exhaustion yet.

Apart from that, the release of the US Durable Goods on Wednesday will be of utmost importance. The economic data is seen as significantly lower at -0.2%, significantly lower than the prior release of 0.8%.

On the Swiss franc front, the release of real retail sales will hog the limelight. Earlier, economic data was -1.6%. Economic stimulus is expected to remain elevated as rising energy bills and food commodity prices boost real retail sales. However, a slippage in economic data would indicate a major slowdown in aggregate demand. This may further weaken Swiss franc bulls.