-

USD/CHF gained traction for the second day in a row on Wednesday despite a softer USD.

-

A positive risk tone weakens safe-haven CHF and supports upticks.

-

Investors now look forward to the US ISM Services PMI for short-term trading opportunities.

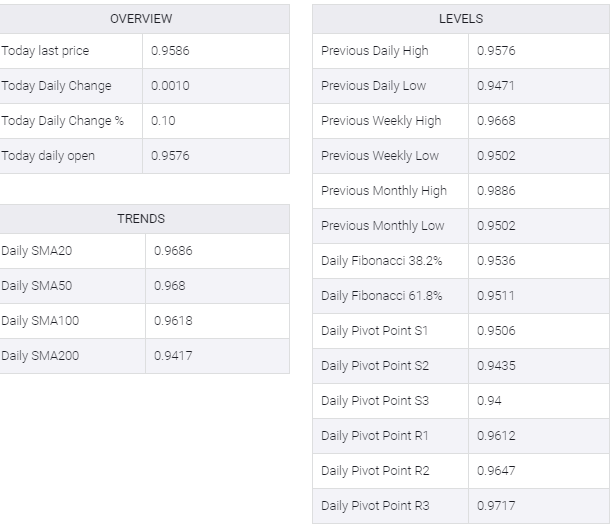

The USD/CHF pair attracted some deep-buying near 0.9540 on Wednesday and turned positive for the second day in a row. Momentum lifted the spot price to a four-day high in the first half of the European session, with bulls now awaiting a sustained move beyond the 0.9600 round-figure mark.

Despite tensions caused by US House Speaker Nancy Pelosi’s visit to Taiwan, largely impressive corporate earnings boosted investor confidence. This is evident from a generally positive tone around equity markets, which is undermining the safe haven Swiss franc and lending some support to the USD/CHF pair.

The US dollar, on the other hand, failed to capitalize on the overnight goodish rebound from a multi-week low amid a mixed performance in the US bond markets. This could be the only factor holding back bulls from placing aggressive bets around the USD/CHF pair and capping any further gains, at least for the time being.

That said, hawkish remarks by several Fed officials, hinting that more interest rate hikes are coming in the near term, might continue to act as a tailwind for the USD. This, in turn, should support the USD/CHF pair to build on the previous day’s strong recovery move from the 0.9470 region, or a four-month low.

Market participants now look forward to the release of the US ISM Services PMI, due later during the early North American session. This, along with the US bond yields, could drive the USD and provide some impetus to the USD/CHF pair. Traders would also take cues from the broader risk sentiment to grab short-term opportunities.