-

The AUD/USD scale is higher for the second day in a row amid the emergence of some selling.

-

Retreating US bond yields, along with a positive risk tone, weigh on the safe-haven buck.

-

Recession fears, unexpected Fed expectations to limit USD losses and cap prime.

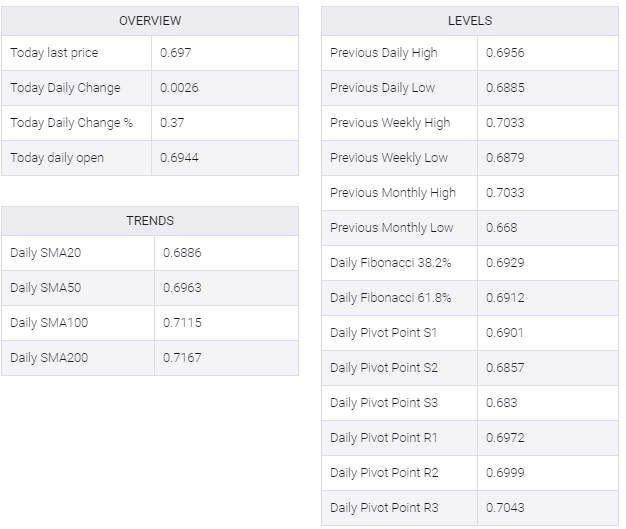

The AUD/USD pair builds on the previous day’s bounce from a one-and-half-week low and gains traction for the second straight day on Thursday. The steady intraday ascent prolongs through the early European session and lifts spot prices to a fresh daily high, around the 0.6975 region.

The emergence of some US dollar selling turns out to be a key factor lending support to the AUD/USD pair. In fact, the USD, so far, has been struggling to capitalize on this week’s goodish recovery from its lowest level since July 5 amid the ongoing decline in the US Treasury bond yields. Apart from this, the recent recovery in the equity markets is further undermining the safe-haven buck and offering additional support to the risk-sensitive aussie.

The USD downtick, however, may be limited in the wake of more dovish comments by several Fed officials this week, indicating that more interest rate cuts are on the way in the near term. Moreover, fears of a growing recession, along with US-China tensions caused by US House Speaker Nancy Pelosi’s visit to Taiwan, could put a lid on the market’s optimistic moves. The aforementioned factors will act as a tailwind for the USD and cap gains for the AUD/USD pair.

Investors may be reluctant to make aggressive bets and prefer to sideline ahead of US monthly jobs data due out on Friday. The popularly known NFP report can influence Fed rate hike expectations and play a key role in influencing USD price dynamics, which, in turn, will determine the next phase of a directional move for the AUD/USD pair.

In the meantime, traders on Thursday would take cues from the release of the usual Weekly Initial Jobless Claims data from the US. This, along with the US bond yields and Fedspeak, would drive the USD demand and provide some impetus to the AUD/USD pair. Apart from this, the broader market risk sentiment would also be looked upon for short-term trading opportunities.