-

USD/JPY hit a more than one-week high in response to the US employment details.

-

The US economy added 528K jobs in July and the unemployment rate fell to 3.5%.

-

Risk-off impulse safe-havens fail to benefit JPY or prevent stronger moves.

The USD/JPY pair took aggressive bids during the first session in North America and hit more than one-week highs, near the 134.85 region in response to the US jobs report.

The headline NFP print broke consensus estimates and showed the US economy added 528K jobs in July, double the expected 250K. Adding to this, the previous month’s reading was also revised to 398K from 372K. Moreover, the unemployment rate surprisingly fell from 3.6% in June to 3.5% pre-pandemic.

Against the backdrop of more hawkish comments by several Fed officials this week, the upbeat employment details revive bets for a larger interest rate hike at the September FOMC policy meeting. In fact, the odds for a 75 bps hike have jumped to 61% from the 40% ahead of the release, which triggers a sharp spike in the US Treasury bond yields.

This, in turn, results in the widening of the US-Japan rate differential, which, along with a strong pickup in the US dollar demand, provides a solid boost to the USD/JPY pair. The combination of supporting factors helps offset the risk-off impulse, which does little to benefit the safe-haven Japanese yen or cap gains for the major.

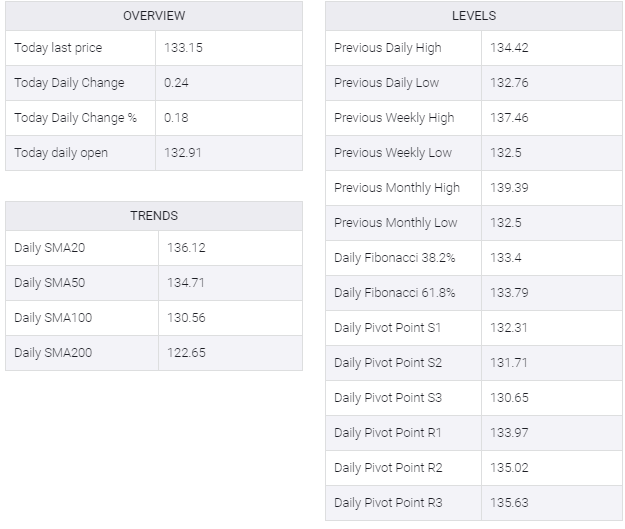

With the latest leg up, spot prices confirm a near-term breakout through the 134.50-134.55 intermediate hurdle, suggesting that any pullback could be seen as a buying opportunity. Some follow-through buying beyond the 135.00 psychological mark would reaffirm the positive outlook and pave the way for a further appreciating move for the USD/JPY pair.