-

EUR/GBP is advancing towards 0.8450 swiftly as a consensus for UK inflation has spurted to 13%.

-

Lower incomes and now higher inflation expectations will create more problems for the BOE.

-

The German Factory Orders have squeezed by 0.4% vs. 0.2% recorded earlier.

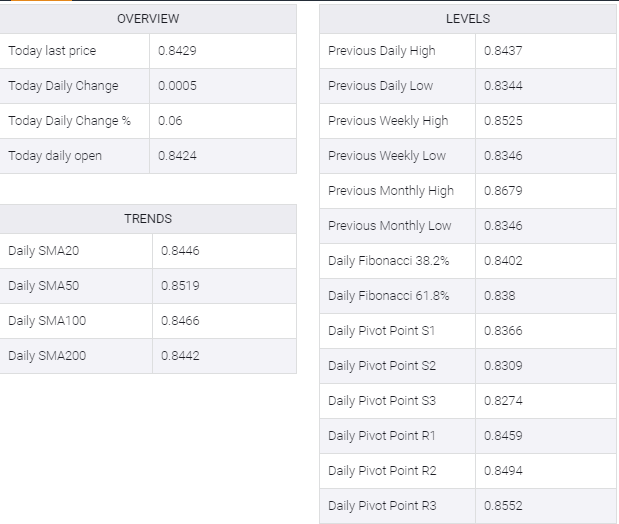

The EUR/GBP pair has turned sideways around 0.8430 in the Tokyo session after a juggernaut upside move from 0.8360 on Thursday. The cross displayed a sheer upside after the Bank of England (BOE) raised its interest rates by 50 basis points (bps). It was a consecutive 50 bps rate hike by the BOE, which pushed the interest rates to 1.75%.

The investment community is aware of the fact that UK household earnings have remained weak over the past few months. Apart from that, the inflation rate in the economy has skyrocketed. Earlier, the inflation rate was at 9.4 percent. Now, BOE Governor Andrew Bailey’s statement that price pressures could reach 13% has created havoc among market participants.

Runaway inflation is now accelerating and the BOE has little room to tighten policy. Thanks to subdued economic data and ongoing political instability following the resignation of UK Prime Minister Boris Johnson, that has created an uneasy situation for the BOE. In the event of an inflation rate of around 13%, the UK economy has a high probability of recession.

On the Eurozone front, German Factory Order data have squeezed by 0.4% vs. the expectation of a squeeze by 0.8% and the prior squeeze of 0.2% on a monthly basis. A lower Factory Orders figures are indicating dismal overall demand in Germany. It is worth noting that Germany is a core member of The European Union (EU) and German economic data carries a significant impact on the shared currency bulls.