-

USD/CAD gains traction for the third successive day and climbs to a fresh multi-week high.

-

Weaker oil prices undermine the loonie and remain supportive amid a modest USD strength.

-

Aggressive Fed rate hike bets and risk-off mood continue to favor safe haven bucks.

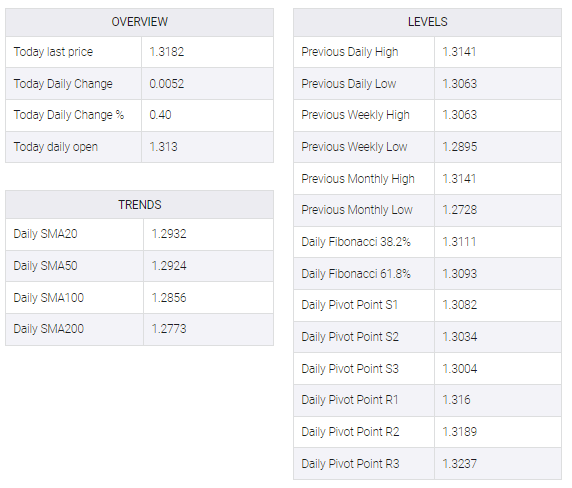

The USD/CAD pair prolongs its bullish move for the third straight day on Thursday and climbs to its highest level since July 14 during the first half of the European session. The strong momentum is sponsored by a combination of factors, which leaves bulls now awaiting a sustained move beyond the 1.3200 mark.

Investors worry that a deepening global economic slowdown coupled with new COVID-19 restrictions in China will dampen demand for fuel. This, in turn, dragged crude oil prices to a one-and-a-half-week low on Thursday and weakened the commodity-linked loonie. Also, the underlying bullish sentiment surrounding the US dollar acts as a tailwind for the USD/CAD pair.

Strong expectations that the Fed will continue to tighten its aggressive policy is supportive of a further rise in US Treasury bond yields. In fact, the yield on 2-year US government bonds, which are highly sensitive to rate hike expectations, hit a 15-year high. In addition, the prevailing risk-off sentiment tends to favor safe haven funds.

The fundamental backdrop appears to lean strongly in favor of US dollar bulls and supports the possibility of further near-term appreciative action for the USD/CAD pair. Hence, there is a distinct possibility of a subsequent strength return to test the YTD peak near the 1.3225 region touched in July. Moreover, any corrective pullback can be seen as a buying opportunity.

Market participants now look forward to the US economic docket, featuring the release of Weekly Initial Jobless Claims and the ISM Manufacturing PMI. This, along with the US bond yields and the risk sentiment, will influence the USD and provide a fresh impetus to the USD/CAD pair. Traders might also take cues from oil price dynamics to grab short-term opportunities.