-

AUD/USD remains depressed near multi-week lows and is under pressure from a combination of factors.

-

Hawkish Fed expectations, higher US bond yields pushed the USD near two-decade highs.

-

Risk-on sentiment leans towards more safe havens and weighs on risk-sensitive Australia.

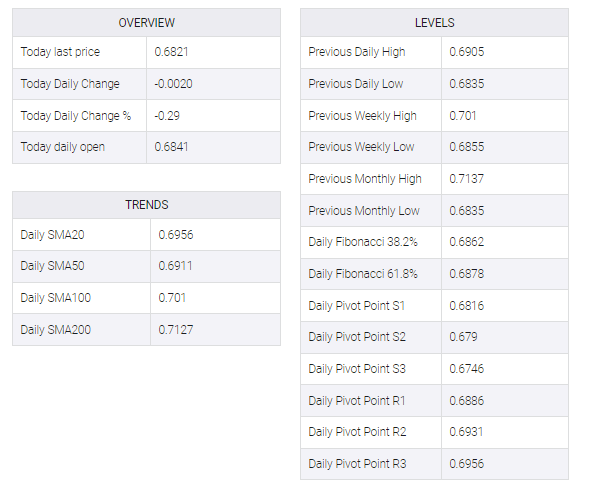

The AUD/USD pair struggles to capitalize on its intraday bounce from sub-0.6800 levels, or the lowest level since June 18 and remains depressed through the early North American session. The pair is currently placed around the 0.6820 region and seems vulnerable to prolonging the recent descending trend witnessed over the past three weeks or so.

The U.S. dollar regained positive traction on Thursday and retreated to inch closer to a 20-year peak earlier this week amid Fed expectations earlier this week. Markets seem confident that the US central bank will be on track to tighten its aggressive policy to control inflation and have priced in a 75 bps rate hike move in September. This supports a further rise in US Treasury bond yields and continues to underpin the greenback, which, in turn, is seen to exert downward pressure on the AUD/USD pair.

Indeed, the yield on 2-year US government bonds, which are highly sensitive to expectations of a Fed rate hike, hit a 15-year high. In addition, the expected US weekly initial jobless claims data and the prevailing risk-off environment provide additional support for the safe haven. Market sentiment remains fragile amid growing concerns about a deepening global economic slowdown. Those fears were further fueled by the disappointing release of the Caixin/Markit Chinese manufacturing PMI on Thursday, which fell to 49.5 in August.

Furthermore, economic headwinds from fresh COVID-19 lockdowns temper investors’ appetite for perceived riskier assets. This is evident from a generally weaker tone around the equity markets, which further contributes to the offered tone surrounding the risk-sensitive aussie. The fundamental backdrop suggests that the path of least resistance for the AUD/USD pair is to the downside and any attempted recovery could be seen as a selling opportunity. Traders now look to the US ISM Manufacturing PMI for short-term opportunities.

The focus, however, remains glued to the closely-watched US monthly employment details, due for release on Friday. The popularly known NFP will provide a fresh insight into the economy’s health in the face of rising rates and stubbornly high inflation. This, in turn, will play a key role in influencing the near-term USD price dynamics and help determine the next leg of a directional move for the AUD/USD pair.