-

USD/JPY hit a 24-year high on Friday and now appears to have entered a consolidation phase.

-

Fed-BoJ policy divergence offset modest USD weakness and continued to lend support.

-

A modest USD weakness seems to cap the upside ahead of the crucial US jobs report (NFP).

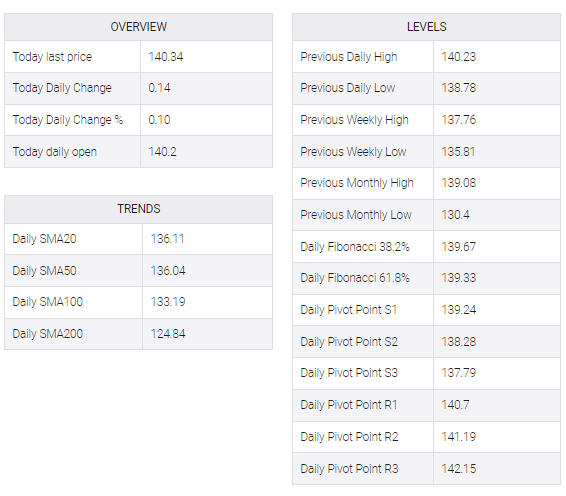

The USD/JPY pair attracts some dip-buying near the 139.85 region and climbs to a fresh 24-year high on Friday. The pair now seems to have entered a bullish consolidation phase and is seen oscillating in a narrow band, just mid-140.00s through the first half of the European session.

The Japanese yen continues to be weighed down by divergent stances taken by other major central banks, including the Bank of Japan and the Federal Reserve. This, in turn, is seen as a key factor acting as a tailwind for the USD/JPY pair. It is worth noting that the BoJ has repeatedly stated that it is committed to an ultra-accommodative monetary policy. In contrast, the Fed is expected to tighten its policy to control inflation.

In fact, markets are currently pricing in a strong possibility of a 75 bps rate hike at the September FOMC meeting. Bets were reaffirmed by recent dovish comments from several Fed officials, which helped push the rate-sensitive 2-year US government bond to a 15-year high. Moreover, the benchmark 10-year US government yield hit a more than two-month high, widening the US-Japan rate differential and weighing heavily on the JPY.

That said, hints at a possible government intervention to prop up the yen seem to hold back bulls from placing fresh bets. In fact, Hirokazu Matsuno, Japanese Chief Cabinet Secretary, told reporters that currency market volatility is heightening recently and sudden exchange-rate fluctuations are not desirable. Adding to this, a modest US dollar pullback from a two-decade high further contributes to keeping a lid on any further gains for the USD/JPY pair, at least for now.

Investors also seem reluctant and prefer to move to the sidelines ahead of the US monthly jobs data, due later during the early North American session. The popularly known NFP report will provide a fresh insight into the labour market conditions in the wake of rising interest rates and stubbornly high inflation. This, in turn, might influence Fed rate hike expectations and drive the USD demand. Nevertheless, the fundamental backdrop suggests that the path of least resistance for the USD/JPY pair is to the upside and any pullback might be seen as a buying opportunity.