-

USD/CHF consolidates around 0.9380-9450s amidst the lack of a catalyst.

-

USD/CHF Price Analysis: A break above the 200-EMA could pave the way towards 0.9550.

The USD/CHF hit a fresh three-day high at 0.9455 but shifted downwards as US Treasury bond yields weakened the US Dollar (USD) against the Swiss Franc (CHF). At the time of writing, the USD/CHF is trading at 0.9419., below its opening price by a minuscule 0.07%.

USD/CHF Price Analysis: Technical outlook

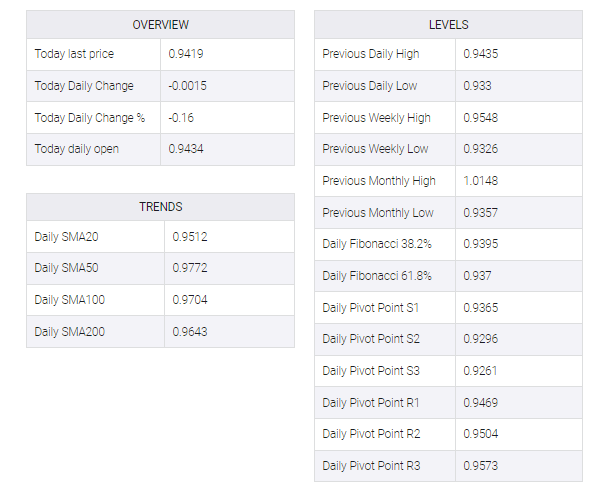

From a daily chart perspective, USD/CHF is biased to the downside, although it is forming a falling wedge that suggests prices will continue to the upside. Notably, USD/CHF registered a new 8-month low of around 0.9326 last Friday, and so far, USD/CHF has remained near 0.9320-0.9455.

Oscillators like the Relative Strength Index (RSI) are almost flat in bearish territory, while the Rate of Change (RoC) suggests that selling pressure is waning. If USD/CHF breaks above 0.9455, it could open the door towards 0.9500.

In the short term, the USD/CHF 1-hour chart depicts the pair as neutral-bullish biased. EMAs are almost flat, close to spot prices, although the 200-EMA at 0.9436 is acting as firm resistance as prices roll around that area. A break above the latter could open the door to the 0.9500 figure, following the November 30 daily high at 0.9547. As an alternative scenario, the first support for USD/CHF would be the intersection of the 20 and 50-EMA near 0.9411-13, then the 100-EMA at 0.9405 and the 0.9400 mark.