-

USD/CHF lower for fourth straight day, takes offer to refresh intraday lower.

-

US Dollar traces a pullback in Treasury yields amid mixed sentiment, holiday mood.

-

Strong US data allowed the greenback to recover but dovish statements in the SNB quarterly report challenged USD/CHF bulls.

-

US GDP, PCE details will be crucial for short-term directions amid holiday mood.

USD/CHF sellers keep the reins around the mid-0.9200s as they refresh intraday low during a four-day downtrend early Thursday.

The Swiss Franc (CHF) pair bounced off its weekly lows the previous day before pulling back from 0.9290. Even so, quotes ended on a negative note on Wednesday after the Swiss National Bank’s (SNB) quarterly report hit mixed US data.

“The degree of uncertainty related to the (Swiss GDP) forecast is still high,” the SNB said in its quarterly economic outlook earlier in the day. The SNB also noted that inflation will remain elevated for the time being.

On the other hand, the US Conference Board’s (CB) consumer confidence hit an eight-month high of 108.3 for December, compared with the market forecast of 101.0 and a revised forecast of 101.40. However, US existing home sales for November were 4.09M MoM ahead of expectations of 4.2M and 4.43M previously.

Elsewhere, Ukrainian President Volodymyr Zelensky’s visit to the US and Russian President Vladimir Putin’s preparations to boost the country’s military capabilities challenge risk appetite.

Additionally, the Bank of Japan’s second-dated bond purchases and retreat in US Treasury yields have recently put downward pressure on the US dollar and weighed on the USD/CHF price.

Given the recent US dollar pullback and holiday mood, US Gross Domestic Product (GDP) for the third quarter (Q3) and Core Personal Consumption Expenditure (PCE) details for Q3 will be important for immediate guidance. Forecasts suggest that US GDP will confirm an annualized growth of 2.9% in Q3 while core PCE is also expected to meet the preliminary forecast of 4.6% QoQ in the said period.

Technical analysis

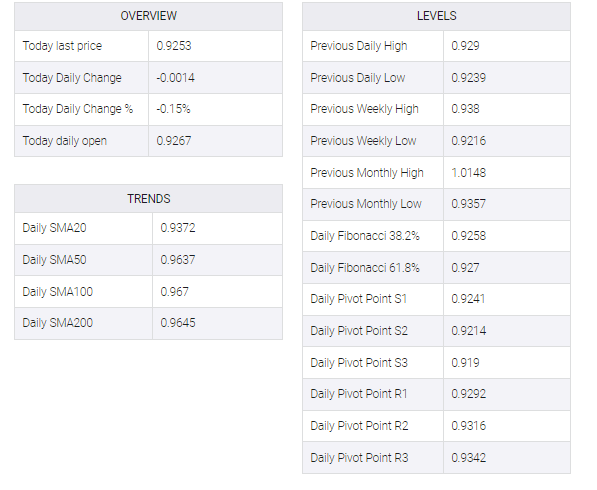

A sustained U-turn from the 10-DMA hurdle, around 0.9300 by the press time, directs USD/CHF towards a five-week-old descending resistance line near 0.9175.