-

USD/CHF slightly falls as the Asian session begins.

-

The surge in Covid cases in China and Western countries encouraged risk aversion that required testing from flights originating in China.

-

USD/CHF Price Analysis: A doji suggests buyers are stepping in, but failure to crack 0.9300 could exacerbate a fall.

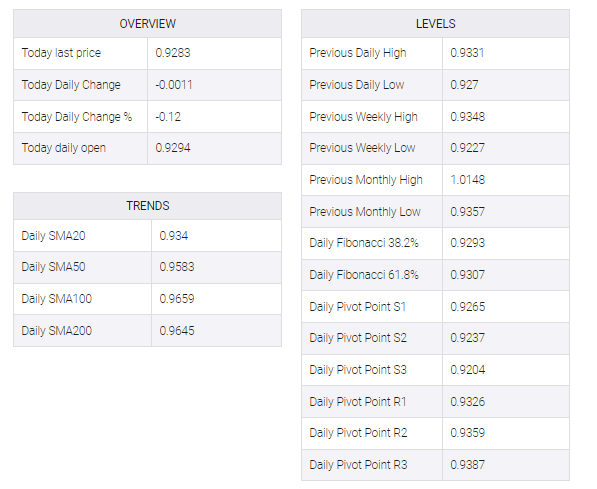

The USD/CHF snaps two days of losses and forms a doji in the daily chart after sentiment shifted sour on the increase of Covid-19 cases in China. Therefore, some Western countries like Italy and the United States (US) would begin soliciting Covid-19 tests from travelers with flights originating in China. At the time of writing, the USD/CHF is trading at 0.9275.

USD/CHF Price Analysis: Technical outlook

From a daily chart perspective, USD/CHF continued its downtrend after breaking below the 200-day exponential moving average (EMA), extending the decline towards 2022 to 0.9116. Nevertheless, since mid-December, the USD/CHF pair has strengthened, but as long as it remains below the 20-day EMA at 0.9339, sellers are in control.

However, the appearance of a doji could pave the way for a rally to the 0.9300 mark, but until USD/CHF clears the 0.9344 mark, risks remain skewed to the downside.

Hence, the first support for USD/CHF will be the December 28 daily low of 0.9244, followed by the December 22 low of 0.9226, before the 0.9200 mark. As an alternative scenario, if USD/CHF clears 0.9300, the pair will be ready to challenge 0.9344.