-

USD/CHF is showing a lackluster performance ahead of FOMC minutes and Swiss CPI.

-

The Swiss franc asset has comfortably shifted above the 50-EMA around 0.9287.

-

A shift into the bullish range by RSI (14) indicates that upward momentum has begun.

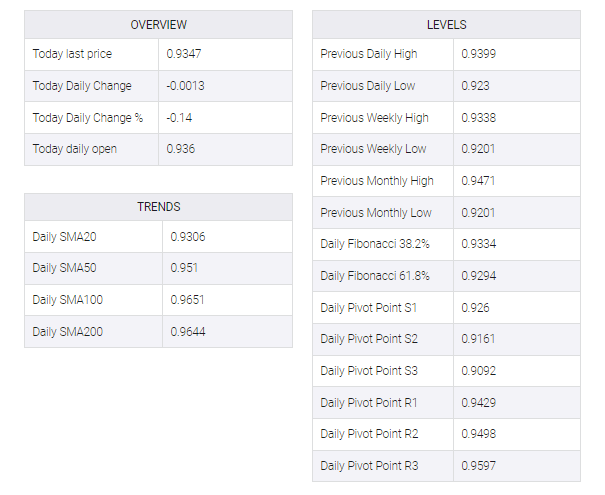

The USD/CHF pair is displaying rangebound moves around 0.9350 in the Asian session. The Swiss franc asset has turned lackluster as investors are likely to make an informed decision after the release of the Federal Reserve (Fed)’s December meeting minutes and Wednesday’s Swiss Consumer Price Index (CPI).

Meanwhile, the risk profile is negative as investors feel uncomfortable pouring funds into risk-averse assets like the S&P500. The US Dollar Index (DXY) is hovering near its two-week high of 104.40.

On the four-hour scale, the Swiss franc pair provided a breakout of potential resistance plotted at the 0.9347 high from December 19. The asset is testing the breakout zone after a mild correction, which will strengthen the upside bias.

The major has moved comfortably above the 50-period exponential moving average (EMA) at 0.9287, indicating that the short-term trend has turned bullish. Also, the pair tried to breach the 200-EMA at 0.9388.

Meanwhile, the Relative Strength Index (RSI) (14) has moved into the bullish range of 60.00-80.00, indicating further upside ahead.

Going forward, a decisive break above the round-level resistance of 0.9400 will drive the asset towards December 6 high at 0.9456 followed by the psychological resistance at 0.9500.

On the flip side, a break below Tuesday’s low at 0.9230 will unleash the Swiss franc bulls and expose the asset for a fresh nine-month low around March 7 low at 0.9162. A slippage below the latter will drag the asset towards January 14 low at 0.9094.