-

EUR/GBP held an aggressive bid on Thursday and snapped a three-day losing streak.

-

The UK’s bleak outlook undermines the Sterling and acts as a tailwind for the cross.

-

Reducing the odds for a more aggressive ECB negotiation could cap further gains.

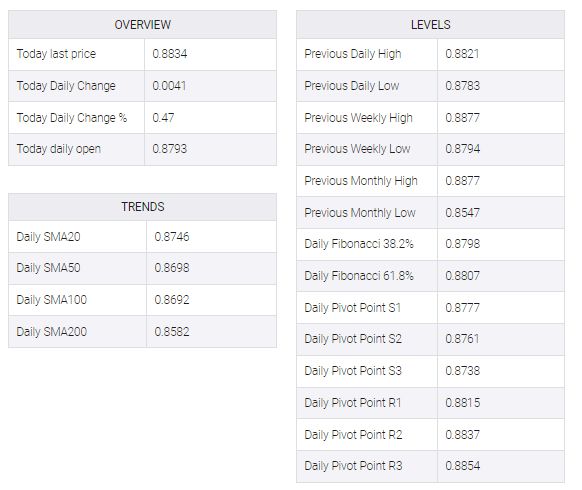

The EUR/GBP cross regains strong positive traction on Thursday and stalls its recent pullback from its highest level since late September. The cross maintains its bid tone through the first half of the European session and is currently placed near the top end of its daily range, just below mid-0.8800s.

The British pound’s relative underperformance comes amid a bleak outlook for the UK economy, which, in turn, appears to lend some support to the EUR/GBP cross. Indeed, the UK manufacturing PMI was finalized at 45.3 in December – marking the lowest level in 31 months. Adding to this, gauges of the UK services sector remained in contraction territory for the third month in a row in December.

The shared currency, on the other hand, found some support from weaker demand for the US dollar, weighed down by the prospect of a small rate hike by the Fed. That said, soft German consumer inflation figures released earlier this week pushed back expectations for more aggressive policy tightening by the European Central Bank. This, in turn, could put a lid on the euro and cap the EUR/GBP cross.

Apart from this, worries about economic headwinds stemming from the protracted Russia-Ukraine war warrant some caution for bullish traders. Hence, it will be prudent to wait for strong follow-through buying before positioning for the resumption of the recent move-up witnessed over the past four weeks or so. Nevertheless, the EUR/GBP cross, for now, seems to have snapped a three-day losing streak to a nearly two-week low.