-

USD/CHF Price Analysis: The week ended positive, albeit down below the 0.9270s

-

USD/CHF remains on the sidelines, although slightly tilted to the downside, and could test the 0.9200 mark.

-

If the USD/CHF reclaims 0.9300, that could pave the way to 0.9400.

The USD/CHF plunged after hitting fresh weekly highs around 0.9408, plummeting beneath the 0.9300 figure, on mixed US economic data that triggered a sell-off in the US Dollar (USD); therefore, the USD/CHF collapsed. At the time of writing, the USD/CHF is trading at 0.9281.

USD/CHF Price Analysis: Technical outlook

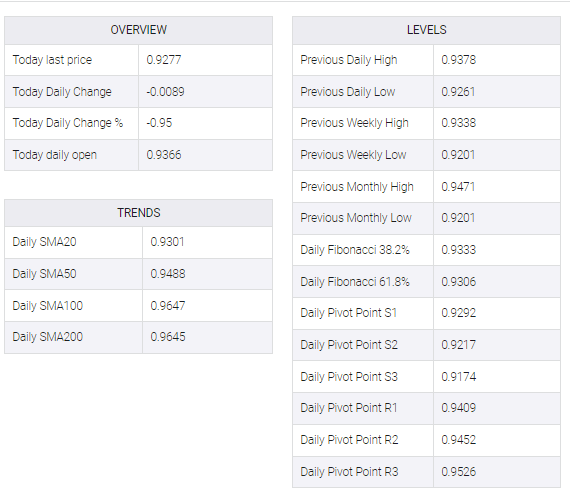

From a weekly chart perspective, USD/CHF ended the week with a gain of 0.45%, after reaching a weekly high of around 0.9408. It should be said that the week ending January 6 has printed a candlestick with a significant upper week, which means sellers are gathering momentum. USD/CHF could test 0.9200 in the near term, with the Relative Strength Index (RSI) extending its decline into bearish territory and the Rate of Change (RoC) target lower.

The USD/CHF daily chart portrays the pair as downward biased, though consolidating and unable to crack the 0,9200 mark. Following the upbreak of a falling wedge, the USD/CHF failed to gain traction and got trapped around the 0.9250-0.9400 mark.

Oscillators like the Relative Strength Index (RSI) shifted gears, turning bearish, while the Rate of Change (RoC) suggests that sellers outpaced buyers.

Therefore, the USD/CHF first support would be the falling wedge top-trendline which turned support at 0.9240, followed by the 0.9200 mark. Break below, and the USD/CHF might fall toward the 2022 low of 0.9091. On the flip side, the USD/CHF first resistance would be the 0.9300 mark. Once cleared, the next resistance would be January’s 6 high of 0.9408, followed by the 50-day Exponential Moving Average (EMA) at 0.9438.