-

The Swiss franc was among the worst performers on Wednesday.

-

US Dollar post mixt results during the American session ahead of US CPI.

-

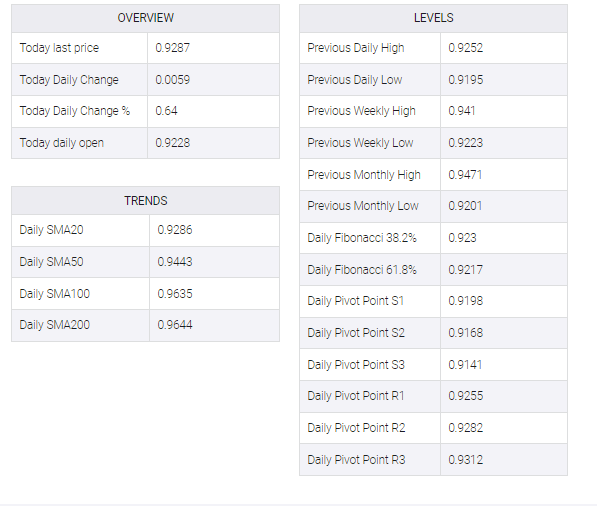

USD/CHF rebounds sharply, above the 20-day SMA.

The USD/CHF is rising by more than 70 pips on Wednesday extending the recovery from the multi-month low it reached on Monday at 0.9165. The pair rose momentarily above 0.9300 for the first time since Friday.

Following two days of gains, USD/CHF is back above the 20-day Simple Moving Average (SMA) that stands at 0.9285. The bias is still bearish but the 0.9200 area is becoming a strong support

CHF drops across the board

The Swiss franc was the worst performer of the American session. Swiss bonds rise At the time of writing the Swiss 10-year bond yield was down more than 10%, at 1.26%, the lowest level since Dec. 19.

USD/CHF accelerated to the upside after breaking above 0.9250. It peaked at 0.9303 and then bounced back to find support at 0.9285. At the same time EUR/USD traded at a fresh multi-month high above 1.0770. EUR/CHF is having its best day in months and has reached levels above parity for the first time since July.

The US Dollar is mixed on Wednesday as market participants await the US CPI report due on Thursday. The index is expected to remain unchanged in December with the annual rate falling from 7.1% to 6.5%.