-

EUR/GBP struggled to gain any meaningful traction and oscillated in a narrow band on Friday.

-

A bleak outlook for the UK economy undermines the Sterling and continues to lend support.

-

Recent hawkish ECB speech underpins the euro and supports the prospect of further gains.

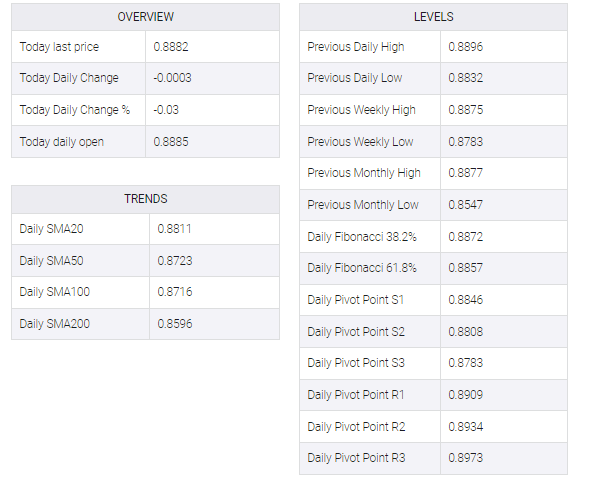

The EUR/GBP cross consolidates its recent gains to the highest level since September 29 touched earlier this Friday and seesaws between tepid gains/minor losses through the early European session. The cross remains below the 0.8900 round-figure mark following the release of the UK macro data, though seems poised to prolong the uptrend witnessed since the beginning of this week.

The UK Office for National Statistics reported that the economy expanded a modest 0.1% in November, compared to estimates of a 0.2% contraction. This, however, marked a significant slowdown from the 0.5% growth recorded in October Furthermore, weaker-than-expected UK industrial and manufacturing production data added to the gloomy outlook for the UK economy, fueling speculation that the Bank of England (BoE) is nearing the end of the current rate-hiking cycle. This, in turn, could weaken the British pound and give some support to the EUR/GBP cross.

The shared currency, on the other hand, continues to receive support from more hawkish signals from the European Central Bank (ECB). Indeed, several ECB officials have spoken out this week and confirmed that they will need to raise interest rates further in the coming months to control inflation. That said, a slight recovery in the US dollar puts a lid on the euro and prevents traders from placing aggressive bullish bets around the EUR/GBP cross. Nevertheless, the fundamental background mentioned above suggests that the path of least resistance for spot prices is to the upside.

Even from a technical perspective, the overnight convincing breakout through the 0.8865-0.8875 supply zone supports prospects for a further near-term appreciating move. Some follow-through buying beyond the 0.8900 round figure will reaffirm the positive outlook and allow the EUR/GBP cross to reclaim the 0.9000 psychological mark.