-

USD/CHF takes offers to reverse the week-start rebound.

-

DXY retreats despite firm Treasury bond yields, bitter sentiment as full market returns.

-

Updates from Davos can entertain traders ahead of US Retail Sales.

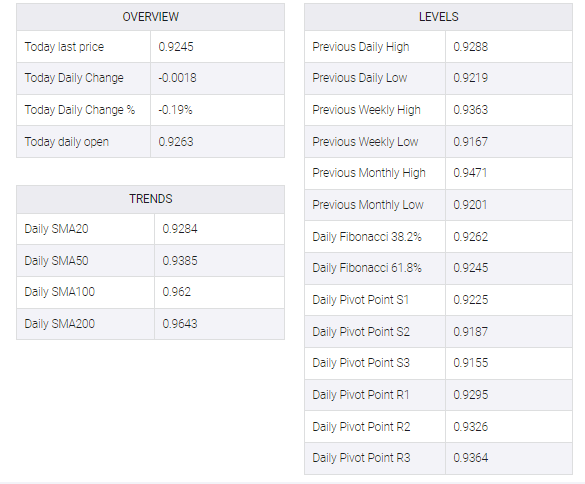

USD/CHF holds lower ground near the intraday bottom of 0.9243 as European traders brace for an active Tuesday, mainly due to the return of the US market players after a long weekend. Adding strength to the pair’s pullback moves could be the mixed sentiment in the market, which in turn probes the US dollar’s rebound from a multi-month low.

That said, market skepticism about Chinese growth numbers adds to the lack of major data/events, as well as fears of a slowdown, to weigh on the risk profile. That underpins a rebound in U.S. Treasury yields, as well as weighing on S&P 500 futures as they retreat from one-month highs.

“Two-thirds of leading private and public sector economists surveyed by the World Economic Forum (WEF) expect a global recession this year, with some 18% considering it ‘highly likely’ – more than double the previous survey. September 2022,” Reuters reports. did

On the same line, China reported upbeat prints of the fourth quarter (Q4) Gross Domestic Product (GDP), as well as Industrial Production and Retail Sales for December. However, the National Bureau of Statistics (NBS) from Beijing mentioned that the foundation for economic recovery is not solid yet, which in turn weighed on the risk profile afterward.

Alternatively, receding fears of the Fed’s monetary policy contraction, especially after the recently mixed US data, allow traders to remain hopeful ahead of this week’s key data, namely US Retail Sales for December, expected 0.1% YoY versus -0.6% prior.

Ahead of that, NY Empire State Manufacturing Index for January, expected -4.5 versus -11.2 prior, may entertain traders while updates from Davos could offer additional hints to the USD/CHF pair traders.

Technical analysis

Despite the latest weakness, the USD/CHF pair is yet to defy the previous day’s bullish signals, flashed via the Doji candlestick on the Daily formation, which in turn keeps the pair buyers hopeful of poking a one-week-old resistance line near 0.9320 by the press time. Alternatively, Monday’s low of 0.9218 puts a floor under short-term declines of the pair.