-

USD/CHF remains downward biased, albeit registering gains of 0.26% on Thursday.

-

Failure of the USD/CHF pair to crack the 20-day EMA will continue to expose the pair to sellers.

-

USD/CHF Price Analysis: The downtrend is still intact, but the major appears to be bottoming.

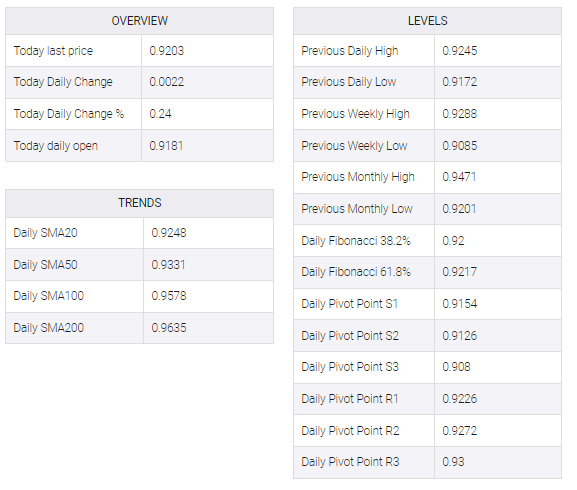

USD/CHF trims some of its Wednesday losses but is falling short of testing the 20-day Exponential Moving AVergae (EMA) at 0.9237, leaving the USD/CHF pair adrift to selling pressure. After hitting a daily high of 0.9225, it has retreated to its current spot price. At the time of writing, the USD/CHF is trading at 0.9200.

USD/CHF Price Analysis: Technical outlook

Although the USD/CHF pair is registering a green day, the pair’s bias remains bearish. As long as buyers recover the January 24 daily high of 0.9360, USD/CHF could move to the neutral-bottom side and have a shot at testing the 50-day EMA at 0.9343, ahead of the January 12 high of 0.9360. The next resistance will be the psychological 0.9400 level.

Given the backdrop, oscillators had failed to support the bullish thesis and remained in negative territory. Except for the Relative Strength Index (RSI), which sits at bearish territory but approaches the 50 mid-line. Once the RSI turns bullish, that could bolster the prospects for higher USD/CHF exchange rates.

As an alternate scenario, the USD/CHF first support would be the 0.9200 mark. Once cleared, the next demand zone to be tested would be today’s low of 0.9158. A breach of the latter and the USD/CHF could dive toward the YTD low of 0.9085.