-

USD/CAD stages a modest recovery from over a two-month low touched earlier this Monday.

-

A softer tone around crude oil prices weakens the loonie and acts as a tailwind for the pair.

-

Subdued USD price action holds back bulls from placing aggressive bets and caps the upside.

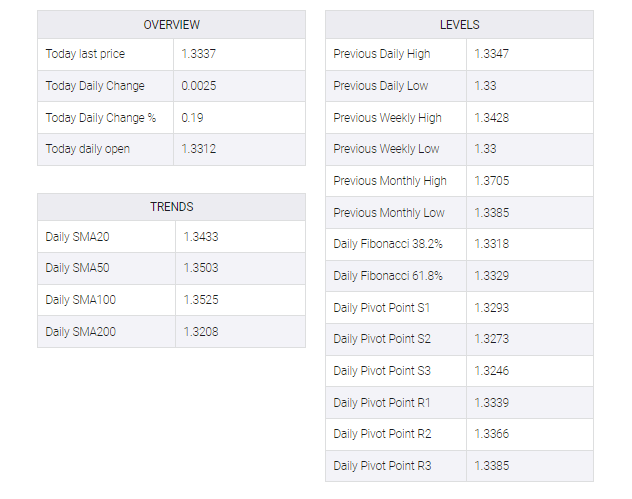

The USD/CAD pair attracts some buyers near the 1.3300 mark and stages a goodish intraday bounce from over a two-month low touched earlier this Monday. The pair sticks to the recovery gains through the first half of the European session and is currently placed near the top end of the daily range, just below mid-1.3300s.

Crude oil prices remained lower for the second day in a row, which, in turn, appeared to weaken the commodity-linked loonie and acted as a tailwind for the USD/CAD pair. An indication of a pick-up in crude exports from Russia’s Baltic ports in early February offset, to a greater extent, optimism about a recovery in demand in China. Adding to that, expectations that OPEC+ will likely keep output unchanged during a meeting this week depend on the black liquid.

The upside for the USD/CAD pair, meanwhile, seems capped amid the underlying bearish sentiment around the US Dollar. The prospects for a less aggressive policy tightening by the Fed keep the USD bulls on the defensive near a nine-month low touched last week. Traders, however, seem reluctant and prefer to move to the sidelines ahead of the highly-anticipated FOMC monetary policy decision, scheduled to be announced at the end of a two-day meeting on Wednesday.

In the absence of any relevant market-moving economic releases, either from the US or Canada on Monday, the aforementioned fundamental backdrop warrants caution before placing directional bets. Nevertheless, the USD/CAD pair, for now, manages to hold above the 1.3300 round-figure mark and remains at the mercy of the USD/Oil price dynamics. The said handle could act as a pivotal point, which if broken decisively should pave the way for a further near-term depreciating move.