-

USD/CAD reverses the previous day’s pullback from seven-week high despite US, Canada holidays.

-

Geopolitical tensions are fueled by sentiment and demand for a shelter in the US dollar.

-

Hawkish Fed versus dovish BoC talks add strength to the upside momentum.

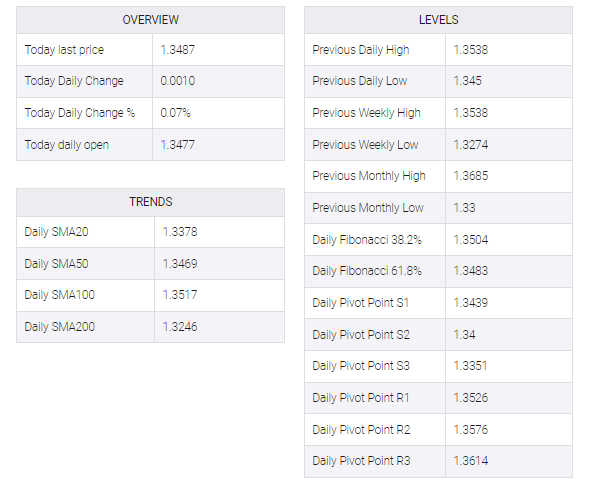

USD/CAD picks up bids to reverse Friday’s corrective move from a 1.5-month high, up 0.08% intraday near 1.3490 during the five-day uptrend to early Monday.

The Loonie pair’s latest gains could be linked to the downbeat prices of Canada’s main export item, namely WTI Crude Oil, as well as the market’s risk-off mood that favors the US Dollar’s demand. It’s worth noting, however, that the holiday in the US and Canada restricts immediate moves of the quote amid a sluggish Asian session.

That said, WTI crude oil prints a six-day downtrend near $76.50 as the US Dollar’s strength joins an increase in the US crude oil stockpile and growing fears of faster Fed rate hikes.

Elsewhere, Japanese Prime Minister (PM) Fumio Kishida pushed for an urgent United Nations (UN) Security Council meeting amid growing fears over North Korea’s firing of two ballistic missiles toward Tokyo, both of which landed outside Japan’s EEZ. Along the same lines, the failure of the latest meeting between US Secretary of State Anthony Blinken and China’s top diplomat Wang Yi seems set to restore US-China relations. The reason may be linked to a Chinese diplomat’s comment that the US must change pace and repair the damage to Sino-US relations through the use of indiscriminate force. Along the same lines, the US ambassador to the United Nations, Ambassador Linda Thomas-Greenfield, said on Sunday that China would be crossing a “red line” if it decided to provide lethal military aid to Russia for its aggression in Ukraine.

Talking about the central banks, the better-than-forecast prints of the US Consumer Price Index (CPI) and Retail Sales followed the previously flashed upbeat readings of employment and output data helped the Federal Reserve (Fed) policymakers to remain hawkish. On the other hand, the Bank of Canada (BoC) officials showed readiness to pause the rate hikes by citing the negative implications for the economy.

Against this backdrop, the S&P 500 Futures print mild losses even as Wall Street closed mixed. It’s worth noting that the US 10-year Treasury bond yields rose to the highest levels since early November in the last week and helped the DXY to print a three-week uptrend.

Moving on, a light calendar and off in the US, as well as Canada, could restrict immediate moves ahead of Tuesday’s BoC CPI and Wednesday’s Federal Open Market Committee (FOMC) Meeting Minutes. Should the Fed policymakers remain hawkish and the Canada inflation number slows, the USD/CAD can witness further upside.

Technical analysis

A daily closing beyond the four-month-old resistance line, close to 1.3515 by the press time, becomes necessary for the USD/CAD bulls to keep the reins.