-

USD/CAD is attempting a recovery move after building a cushion near 1.3480 as investors turn risk-averse.

-

The Loonie has sensed a buying interest to near 1.3470, the region where the asset delivered a breakout.

-

Canada’s core inflation is seen higher at 5.5% against 5.4% released earlier.

The USD/CAD pair has attempted a rebound after building a cushion around 1.3470 in the early Asian session. The Loonie asset is looking to extend its recovery as the risk aversion theme is gaining traction after a warning from the United States to China for providing lethal support to Russia against Ukraine.

Investors should brace for volatility as US markets remain closed on Monday for President’s Day. The US Dollar Index (DXY) experienced an intermediate cushion around 103.50 on further movement on talks of renewed US inflation concerns. Canada’s Consumer Price Index (CPI) release on Tuesday will provide guidance for the Canadian dollar’s next move.

Canada’s core inflation that strips out oil and food prices is seen higher at 5.5% vs. the prior release of 5.4% on an annual basis. While the annual headline CPI is seen lower at 5.7% against 6.3% released in a similar period.

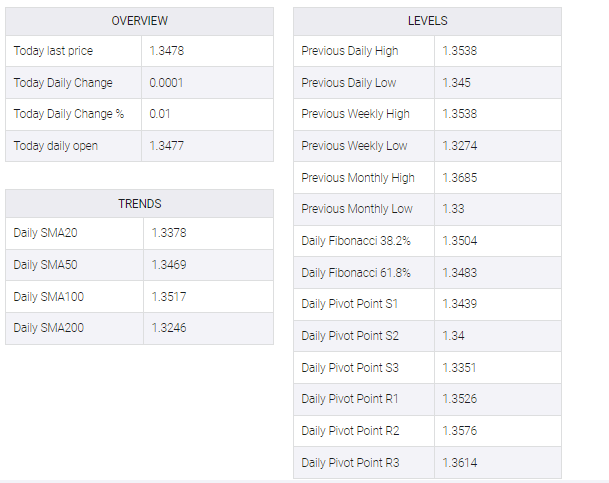

USD/CAD has sensed a buying interest after a correction to near 1.3470 on a two-hour scale, the region where the asset delivered a breakout on Friday. A test and reverse situation after a breakout favors more upside move ahead.

The 20-period Exponential Moving Average (EMA) at 1.3466 is acting as a major support for the US Dollar.

Meanwhile, the Relative Strength Index (RSI) (14) is looking to reclaim the bullish range of 60.00-80.00 ahead.

Going forward, a break above February 20 high at 1.3483 will drive the asset toward January 19 high at 1.3521 followed by January 6 low at 1.3538.

On the flip side, a downside move below February 13 low at 1.3325 will drag the Loonie asset toward February 2 low at 1.3262. A slippage below the latter will expose the asset to the horizontal support plotted from November 15 low at 1.3226.