-

EUR/GBP retreats from intraday high, snaps two-day rebound from monthly low.

-

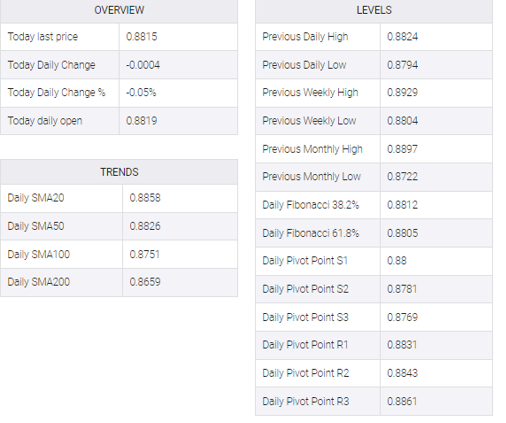

The one-week-old resistance line, the key Fibonacci retracement level challenges the immediate upside.

-

0.8840 appears a tough nut to crack for the EUR/GBP bulls.

-

Multiple levels surrounding 0.8760 can probe bears afterward.

EUR/GBP bears return to the table, after a two-day absence, as the quote eases from the intraday high to 0.8815 during the initial hour of Friday’s European session.

In doing so, the cross-currency pair fades bounce off the lowest levels since January 31 while retreating from the convergence of the one-week-long descending trend line and 61.8% Fibonacci retracement level of January 19 to February 03 upside, close to 0.8820 at the latest.

Adding strength to the pullback moves is the sluggish RSI (14) near the 50 levels, as well as the pair’s previous downside break of the support lines from late January.

As a result, EUR/GBP bears look set to revisit the latest trough around 0.8780. However, the multiple levels identified in late January could challenge the pair’s sellers next around 0.8760.

Should the quote remains weak past 0.8760, the odds of witnessing a fresh low of the year 2023, currently around 0.8720 can’t be ruled out.

On the contrary, a successful break of the 0.8820 resistance confluence isn’t an open welcome to the EUR/GBP bulls as the previous support line from January 30, around 0.8830 by the press time, could challenge the upside moves.

It’s worth noting that the support-turned-resistance from January 19 joins the 200-Simple Moving Average (SMA) to highlight the 0.8840 as the key upside hurdle.

EUR/GBP: Four-hour chart

Trend: Further downside expected