-

EUR/GBP gains some positive traction for the second straight day, though lacks bullish conviction.

-

A modest downtick in the Eurozone consumer inflation caps the upside for the Euro and the cross.

-

Abundantly suggested tone around the Sterling Pound supports the potential for additional gains.

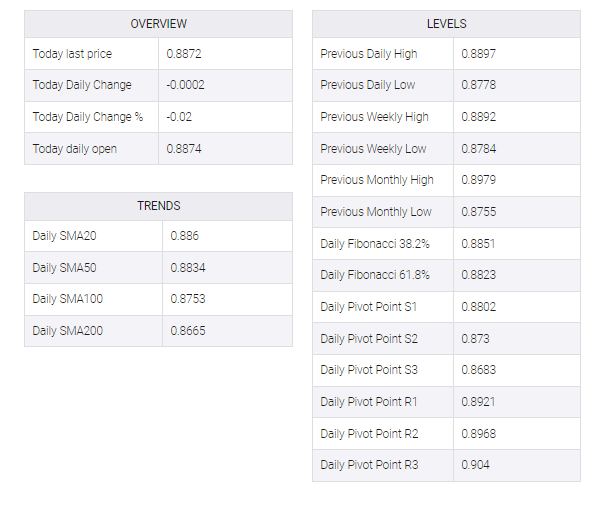

The EUR/GBP cross builds on this week’s bounce from the vicinity of the 100-day SMA near the 0.8755-0.8750 region, or a one-month low, and edges higher for the second successive day on Thursday. The cross, however, retreats a few pips from a nearly two-week high touched during the first half of the European session and is currently placed around the 0.8875-0.8870 zone.

The common currency continued to outperform against its British counterpart amid growing bets for an additional jumbo rate hike by the European Central Bank (ECB), which, in turn, acted as a tailwind for the EUR/GBP cross. Expectations were lifted by dovish comments from European Central Bank (ECB) officials and strong consumer inflation data released this week from France, Spain and Germany – the eurozone’s three largest economies.

Indeed, Bundesbank President Joachim Nagel said on Wednesday that the ECB’s announced interest rate move for March would not be the end and that further significant increases may be needed later. Adding to this, French central bank governor Francois Villeroy de Galhau said that the ECB is committed to returning inflation to 2% by the end of 2024 and that it is desirable to reach the terminal rate by September at the end of the summer.

The EUR/GBP cross, however, struggles to capitalize on the intraday uptick and remains below the 0.8900 mark after the Eurostat reported that the annualized Eurozone HICP eased to 8.5% YoY rate in February from the 8.6% previous. This, along with a goodish pickup in the US Dollar demand, holds back the Euro bulls from placing aggressive bets. Meanwhile, the downside seems cushioned amid the heavily offered tone surrounding the British Pound.

The market anxiety over the new UK-EU Brexit deal on the Northern Ireland Protocol is seen weighing on the Sterling Pound. Moreover, the price action suggests that additional rate hike by the Bank of England (BoE) is already fully priced in the markets. This, along with some speculations the UK central bank would pause the current tightening cycle, favours the EUR/GBP bulls and supports prospects for a further near-term appreciating move.