-

USD/CAD extended its sideways price advance early in the European session.

-

Bullish Oil prices underpin the Loonie and act as a headwind amid a modest USD weakness.

-

The downside remains cushioned ahead of Fed Chair Jerome Powell’s semi-annual testimony.

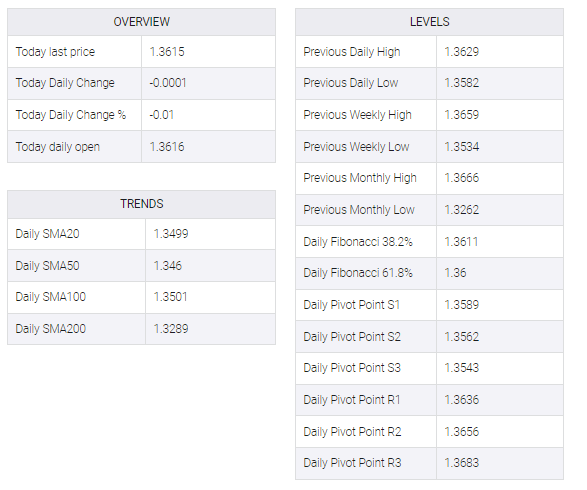

The USD/CAD pair continues with its struggle to gain any meaningful traction on Tuesday and remains confined in a familiar trading range around the 1.3600 mark through the early European session.

The latest optimism over a fuel demand recovery in China pushes Crude Oil prices to the highest level since last January, which, in turn, underpins the commodity-linked Loonie. Apart from this, a generally positive risk tone is seen weighing on the safe-haven US Dollar and acting as a headwind for the USD/CAD pair. The downside, however, remains cushioned as traders seem reluctant to place aggressive bets ahead of this week’s key event/data risks and await a fresh catalyst before positioning for the next leg of a directional move.

The main focus on Tuesday will be Fed Chair Jerome Powell’s semi-annual congressional testimony, which will be seen for clues about the path of future rate-hikes amid bets for a 50 bps lift-off at the March FOMC meeting. Expectations were lifted by incoming US macro data, which indicated that inflation was not slowing as quickly as hoped and pointed to an economy that remains resilient despite rapidly rising borrowing costs. Adding to this, several FOMC policymakers have recently supported the case for higher rate hikes.

In contrast, the Bank of Canada (BoC) had signalled in January a likely pause in its tightening cycle and is now expected to leave rates unchanged at the upcoming policy meeting on Wednesday. This will be followed by the monthly employment details from Canada and the US (NFP), which should help determine the near-term trajectory for the USD/CAD pair. Nevertheless, the divergent Fed-BoC policy outlook suggests that the path of least resistance for spot prices is to the upside and any meaningful dip is likely to get bought into.