-

USD/CHF continues to bid above 0.9400 and is expected to extend its upside journey amid an overall risk-off mood.

-

The upside bias for the USD index is intact amid expectations of more resilience in the US labor market.

-

An increase in US Average Hourly Earnings data might fuel inflationary pressures ahead.

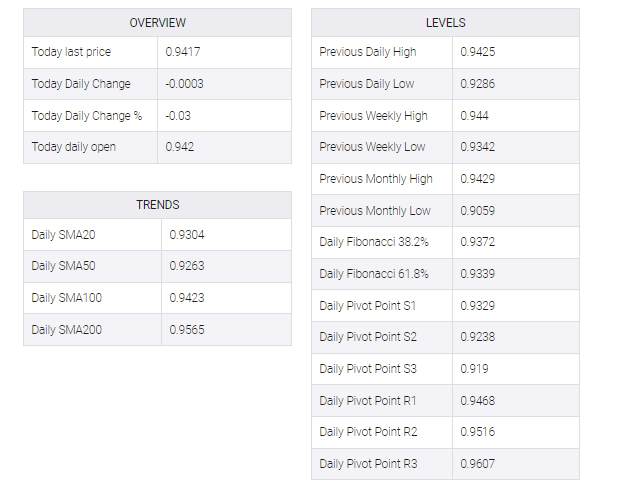

The USD/CHF pair is holding its auction above the critical support of 0.9400 in the early Asian session. The Swiss Franc asset is expected to resume its upside journey later as solid United States labor market data indicates that the fears of persistent inflation in the sentiment of Federal Reserve (Fed) policymakers are real and bigger rates are in pipeline to squeeze galloping inflation.

S&P500 futures settled Wednesday’s session on expectations that the Federal Reserve (Fed) is considering higher terminal rates due to renewed fears of a higher Consumer Price Index (CPI). The US Dollar Index (DXY) has moved into a volatility contraction phase and upside bias remains intact amid expectations of more resilience in the labor market.

Meanwhile, the overall risk-aversion theme has failed to infuse fresh blood into the US Treasury yields. The alpha delivered on 10-year US Treasury bonds has failed to sustain above 4.0%.

Fed chair Jerome Powell continued his hawkish remarks on Wednesday citing “Costs of not getting inflation down will be extremely high.” He further added, “Costs of failure to control inflation would be much higher than costs of controlling it.” Fed’s Powell also discussed the positive impact of China’s reopening to the prices of commodities, which will also propel price pressures. However, the reopening measures will also trim supply chain disruptions.

After an upbeat US Automatic Data Processing (ADP) Employment Change data, investors are shifting their focus toward US Nonfarm Payrolls (NFP) data, which is scheduled for Friday. The economic data is seen at 203K lower than the former bumper release of 517K. The Unemployment Rate is seen steady at 3.4%. Investors would be worried about Average Hourly Earnings data, which is expected to increase to 4.8% vs. the prior release of 4.4% on an annual basis.

On the Swiss Franc front, Swiss National Bank (SNB) Chairman Thomas J. Jordan stated the inflation in Switzerland is low in international comparison but above the handling capacity of the SNB. He further explained that the appreciation of the Swiss Franc has protected them from imported inflation.