-

USD/CAD is seen consolidating its recent strong gains to the highest level since October.

-

Slight USD pullback from multi-month top cap gains amid rising oil prices.

-

The fundamental backdrop supports prospects for an extension of the bullish trajectory.

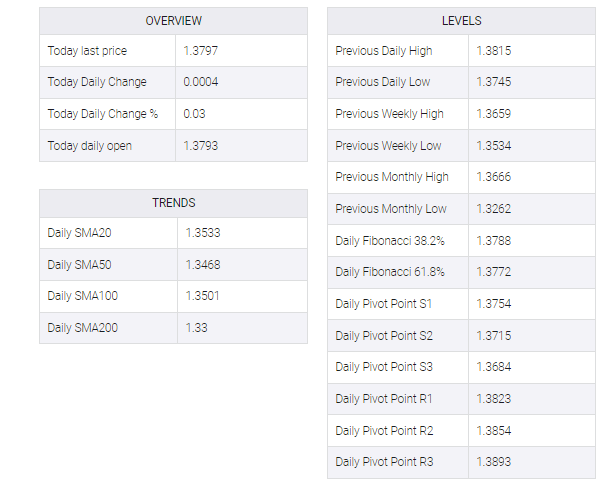

The USD/CAD pair enters a bullish consolidation phase and oscillates in a narrow trading band around the 1.3800 mark, just below its highest level since October touched earlier this Thursday.

The subdued price action comes on the back of a modest US Dollar pullback from over a three-month high. This, along with an uptick in Crude Oil prices underpin the commodity-linked Loonie and acts as a headwind for the USD/CAD pair. That said, the downside remains cushioned amid hawkish Fed expectations and worries about a deeper global economic downturn.

In fact, markets have started pricing in a jumbo 50 bps lift-off in the upcoming FOMC meeting on March 21-22. Fed Chair Jerome Powell lifted bets on Wednesday, reiterating that interest rates will need to go higher and possibly faster to tame stubbornly high inflation. This favors higher US Treasury bond yields and USD bulls.

Meanwhile, the prospects for further tightening the Fed add to worries about economic headwinds stemming from rapidly rising borrowing costs. This, along with fading optimism over a strong Chinese economic recovery, which could dent fuel demand, should keep a lid on Crude Oil prices, suggesting that the path of least resistance for the USD/CAD pair is to the upside.

The bullish outlook is reinforced by the fact that the Bank of Canada became the first major central bank to pause its rate-hiking cycle on Wednesday amid signs of easing inflationary pressure. The USD/CAD pair seems poised to aim to reclaim the 1.3900 mark and extend the positive momentum further towards the October 2022 swing high, around the 1.3975-1.3980 zone.

Traders now look to the US economic docket, featuring the release of Challenger Job Cuts and the usual Weekly Initial Jobless Claims data, due later during the early North American session. The focus, however, will remain on the monthly Canadian jobs data, which, along with the crucial US NFP report, should provide a fresh directional impetus to the USD/CAD pair.