Central bank watchers should be pleased with incoming data for the week of March 13th, as it could force two central banks to seriously consider a pause at their next meetings if data arrives soft enough. Both RBA and BOE governor’s have floated the potential for a pause and highlighted how important the next batch of data is. Australia present household spending and the employment report, whilst the UK releases key inflation data.

The US inflation report will be highly anticipated, although in this case is could be the difference between a 25 or 50bp Fed hike (or perhaps bets of a 6% terminal rate).

And we also have an ECB meeting, which we hope will provide greater clarity on the central banks pace of tightening beyond May’s meeting.

The week that was:

- Jerome Powell delivered very hawkish remarks during his testimonies to the House and Senate Banking Committees

- Fed fund futures implied a probability of over 70% for a 50bp Fed hike ECB member Holzman called for four more 50bp hikes (which would take rates from 3% to 5%)

- The 2-year treasury yield rose to over 2% for the first time since 2007

- The BOC became the first major central bank to pause their tightening cycle, holding rates at 4.5%

- The RBA delivered a dovish 25bp hike, taking rates to 3.65%

- RBA governor Lowe said in a speech that the RBA are approaching a time where they can consider a pause in their tightening cycle

- China’s government projected growth for 2023 to be around 5% (low by historical standards, but high relative to 2022’s 3%)

The week ahead (in a nutshell):

Monday

- US: Employment trends index

- New Zealand: Food price index, rental price index, Business PSI

- Japan: Business survey index (BSI),

Tuesday

- US: Consumer price index, Cleveland Fed CPI, NFIB business optimism index

- UK: Consumer price index, labour market statistic

- Australia: Household spending, business turnover, NAB business confidence, Westpac consumer sentiment

- New Zealand: Migration and visitors,

- Canada: Manufacturing survey,

- Switzerland: Producer and import price index

Wednesday

- US: Producer price index, mortgage applications, retail sales, business inventories

- EU: Industrial production, German wholesale price index

- Australia: Weekly payrolls data

- New Zealand: Balance of payments

- Canada: Retail, wholesale and telecoms services price index

- China: Press conference for the economic situation, Industrial production, fixed asset investment, real estate investment, retail sales, energy production

Thursday

- US: Import and export prices indexes, building permits, Philly fed business index

- EU: ECB interest rate decision, Leading index,

- Australia: Labour force report

- New Zealand: Q4 GDP, M1 money supply

- Canada: Wholesale trade

- Switzerland: Economic forecasts by the Federal Government,

- Japan: Current account balance, Machinery orders, trade balance, industrial output

- China: House prices

Friday

- US: Employer Costs for Employee Compensation, industrial production, manufacturing output, University of Michigan consumer sentiment (preliminary)

- EU: Consumer price index, labour cost index

- Canada: Producer price index, raw materials prices

The week ahead (in detail):

The ECB are expected to hike by 50bp

The ECB hiked their base by 50bp in February to 3.0%, which is the highest rates have been since 2008. They have added 300bp so far this tightening cycle, and are expected to hike by another 50bp on Thursday. Recently we saw money markets fully price in a 4% terminal rate, which leaves the door open for another 50bp hike in May. But some members have been calling for as much as 4x 50bp hikes to take rate to 5%.

What traders would like to hear next week is some more clarity. Whilst the ECB’s press release suggested the ECB are open to hikes beyond March, Lagarde’s press conference created a lot of confusion and inadvertently muddied the waters. So hopefully we’ll have a better understanding at the pace of tightening over the May and June meetings.

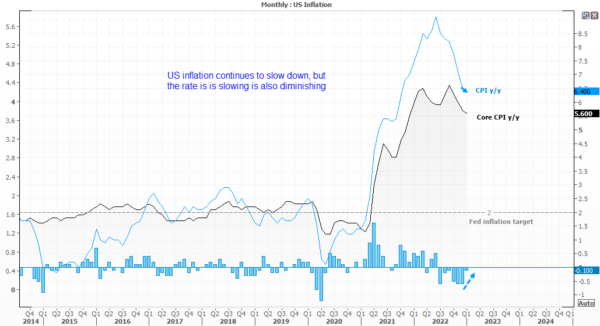

US inflation data remains a hot topic

Traders cannot get enough on inflation data or Fed comments. So they’ll be pleased to hear that US inflation data is scheduled for Tuesday, and it can easily move the dial over how aggressively the Fed hike rates and to what level. But Friday’s NFP data also impacts the significance of inflation to a degree, because if we get another abnormally hot NFP figure along with rising inflation, it could likely trigger a strong bullish reaction for US as traders begin to prove in a 6% plus terminal rate. Whereas a weak NFP prints and soft inflation report could send the dollar sharply lower, and traders price in a 50bp March hike and lower terminal rate.

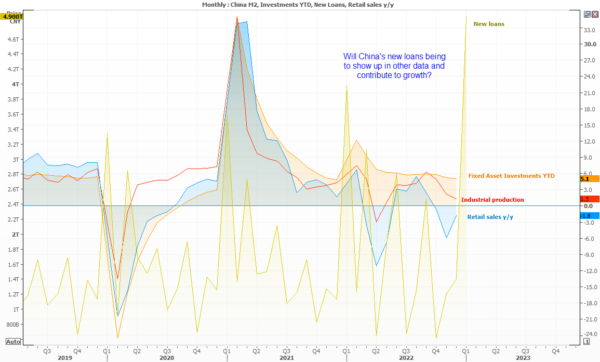

China’s data dump on Wednesday

Now the Chinese government has announced their growth target for 2023 is ‘around’ 5%, incoming data such as retail sales, industrial production and investment will be scrutinised by investors for them to assess just how likely this target is. And there are likely expectations for data to improve, given the great reopening, and strong data could provide a risk-on vibe to support equities and oil as it points to stronger global growth. But the opposite is also true, where a weak data set fans fears of a slowdown and weigh on sentiment.

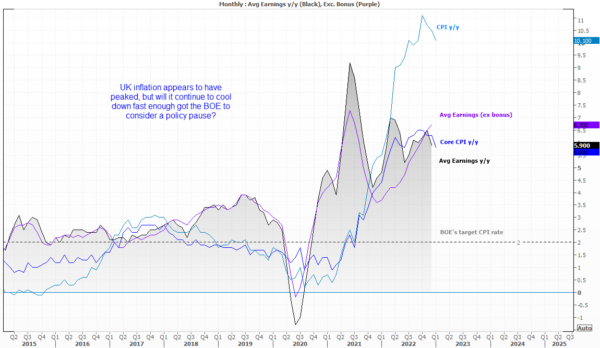

UK inflation

Inflation appears to have peaked in the UK, but the key question now is whether it will continue to slowdown fast enough and consistently as the BOE would like. In a speech on March 2nd, BOE Governor Bailey reiterated that headline inflation was “projected to fall sharply over the rest of year, more so in the second half” but that further tightening would be required if inflation was more persistent than forecast.

To highlight the importance of UK’s inflation report on Tuesday, Bailey they need to keep a “very close eye on domestic inflation pressures”, “a further set of data will be coming in before our next policy meeting”, and then saying “I would caution against suggesting either that we are done with increasing Bank Rate, or that we will inevitably need to do more. Some further increase in Bank Rate may turn out to be appropriate, but nothing is decided”.

In a nutshell, this inflation report could be the difference between the BOE hiking or pausing at their meeting on March 3rd.

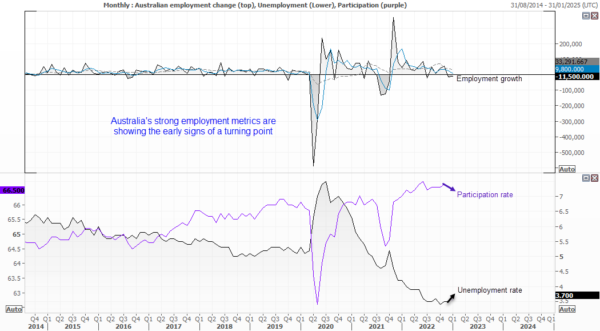

Household spending and labour force statistics in focus for AUD watchers

With the RBA delivering a dovish 25bp, tipping their hat to employment and Governor Lowe speaking of the potential for a pause in their tightening cycle, incoming data for RBA watchers is more important than ever. Household spending is softening but continues to be a ‘source of uncertainty’, but a softer print on Tuesday could be bullish for the ASX 200 and bearish for the Aussie, as it plays into the ‘RBA pauses’ theme. And bad data could be good if it were to be coupled with a weak employment report on Thursday as it would imply that cracks continue to widen in Australia’s economy and that the hikes are really starting to hurt.

— Written by Matt Simpson