-

USD/CHF prints mild losses to consolidate the biggest daily gains since 2015 amid mixed sentiment.

-

Credit Suisse eyes SNB loan to overcome liquidity crisis.

-

Global policymakers rush to placate financial market fears after US, European banks tease pessimists.

-

Second-tier Swiss, US data may entertain traders but bond market moves are the key to clear directions.

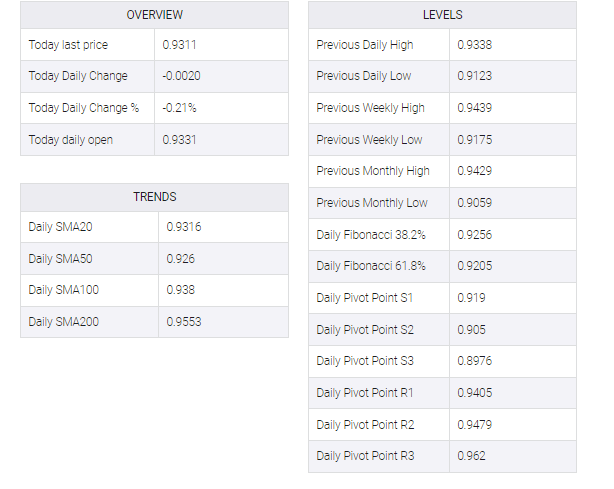

USD/CHF clings to mild losses near 0.9320 as it holds lower ground near intraday bottoms early Thursday. That said, the Swiss currency pair rallied the most since 2015 on Wednesday as Credit Suisse fueled financial market fears. However, efforts by global policymakers to moderate the risk-off mood appear to be helping the Swiss currency pair consolidate its latest moves.

Among key positive developments, Reuters headlines suggest Credit Suisse eyes major attention on borrowing up to CHF50 billion from the SNB to bolster liquidity. Along the same lines could be news that anonymous sources said US banks are less vulnerable to a Credit Suisse debacle. Moreover, market chatters also seem to avoid earlier risks, with the Bank of England (BoE) holding emergency talks and the Federal Reserve (Fed) and ECB suggesting no immediate negative reaction during their monetary policy meetings.

Among those plays, S&P 500 futures rose half a percent to reverse the previous day’s losses to around 3,940 while the US 10-year Treasury bond yield was steady around 3.49% after its biggest drop in four months on Wednesday. That said, two-year Treasury bond coupons pared further declines of around 3.96% after falling to their lowest level since September 2022.

On Wednesday, Saudi National Bank’s refusal to deposit more funds into Credit Suisse triggered the credit default swap (CDS) of the main European bank and triggered a crisis for financial markets on Wednesday. Adding to the bitter sentiment was the news that European Central Bank (ECB) officials had approached the banks to ask about Credit Suisse’s exposure.

It should be noted that the mixed US data failed to gain any major attention even as the US dollar rose. That said, US retail sales fell to -0.4% in February vs. -0.3% expected and an upwardly revised 3.2% earlier while the Producer Price Index (PPI) slid to 4.6% YoY and 5.6% market forecast from 5.7% in January. Also, the NY Empire State Manufacturing Index fell to -24.6 for March compared to -8.0 and -5.8 prior analyst estimates.

Going forward, the Swiss SECO economic forecast and second-tier US data on employment, manufacturing and housing activities can entertain you traders of the USD/CHF pair. However, the main focus will be on bond market moves and headlines around Credit Suisse, Silicon Valley Bank (SVB) and Signature Bank.

Technical analysis

Overbought RSI, failure to cross the 100-SMA and the previous support line from early February, close to 0.9325 and 0.9350 in that order, USD/CHF bears remain in the driver’s seat.