-

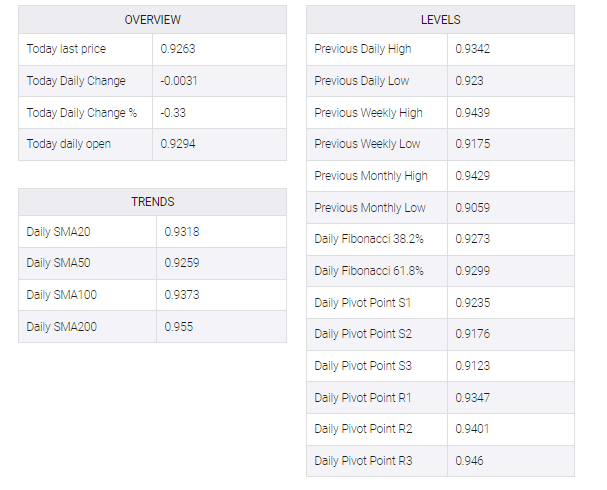

USD/CHF retreats to 0.9250 amid broad-based US Dollar weakness and softer US Treasury yields.

-

Swiss National Bank’s decisive action alleviates Credit Suisse’s liquidity concerns.

-

Market uncertainty looms as questions on the liquidity front remain unresolved.

The USD/CHF is back from the 0.9300 sign at the beginning of Asian Trading Hours on Friday. The vast-based US dollar weakness has deleted the pair to delete some of the previous profits and move Thursday to Thursday’s lower 0.9230. Some of the soft US treasury yields have pushed US dollars less than a high risk hunger.

Swiss banks have been strengthened by Swiss Bank Credit Swiss related circumstances.

The Swiss National Bank (SNB) took immediate action and provided assistance for the credit Swiss after the international opponent’s pressure, according to some reports. Then, SNB wants to provide a covered loan facility to the credit Swiss to help them escape the trap of the stars.

Credit Swiss says it will borrow up to 50 billion Swiss Frank ($ 53.7 billion) from Swiss National Bank. The bank has called the debt “a decision -making step to strengthen the starry.”

On the United States Front, we have seen a growing effort to revive First National Bank by important players like JPMorgan, Citibank, Bank of America, and many others, which have provided about $ 30 billion pools.

The original question is still unresolved, because the market does not know how many chapters have been published on the liquidity front. USD/Chf can become unstable if we see some increase in the liquidity problem.