-

USD/CHF comes under some renewed selling pressure on Tuesday amid sustained USD selling.

-

Bets for a less hawkish Fed offset a further recovery in the US bond yields and weigh on the USD.

-

The risk-on environment could undermine the safe-haven CHF and lend some support to the pair.

-

Investors might also prefer to move to the sidelines ahead of the crucial central bank event risks.

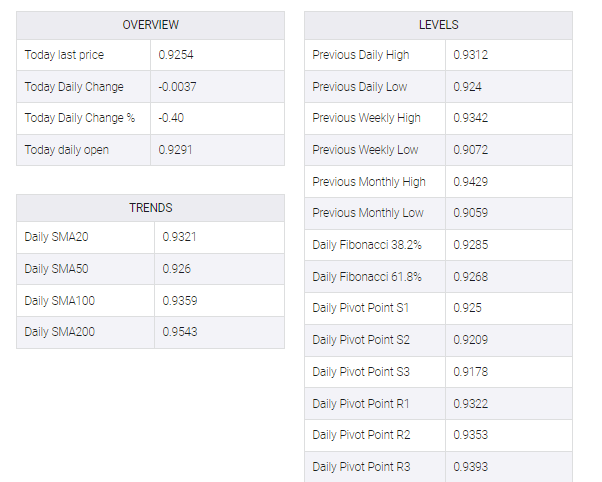

The USD/CHF pair attracted fresh sellers after an early advance to the 0.9315 area on Tuesday and extended a sharp intraday decline in the first half of the European session. The pair dropped to the 0.9250-0.9245 area in the last hour and reversed a large part of the previous day’s positive move.

The Swiss franc (CHF) supported recent optimism led by news that UBS will rescue Credit Suisse in a $3.24 billion deal, helping ease fears of wider contagion risks. This, with the US dollar selling off for the fourth straight day amid expectations that the Federal Reserve (Fed) will soften its hawkish stance, appears to be exerting downward pressure on the USD/CHF pair.

Indeed, markets have priced in a small 25 bps rate hike in March and the US central bank may begin cutting rates in the second half of the year. This, to a greater extent, offset further recovery in US Treasury bonds and dragged the USD index, which tracks the greenback against a basket of currencies, to its lowest level since February 14 in the last hour.

However, it remains to be seen whether the bears can maintain their dominant position amid the generally positive tone around equity markets, which weakens the safe-haven CHF. Traders may also refrain from placing aggressive directional bets and prefer to wait for the outcome of the two-day FOMC monetary policy meeting scheduled to be announced during the US session on Wednesday.

The main focus, however, will be on the accompanying policy statements and updated economic projections. That, along with Fed Chair Jerome Powell’s comments at the post-meeting press conference, will be closely scrutinized for clues about the path of future rate-hikes. As a result, this will impact the USD and give fresh impetus to the USD/CHF pair ahead of the Swiss National Bank (SNB) meeting on Thursday.