-

USD/CAD regains positive traction on Tuesday and draws support from a combination of factors.

-

Bearish Oil prices undermine the Loonie and lend some support amid a modest USD strength.

-

Bets for a less hawkish Fed cap gains for the buck and the pair ahead of the Canadian CPI report.

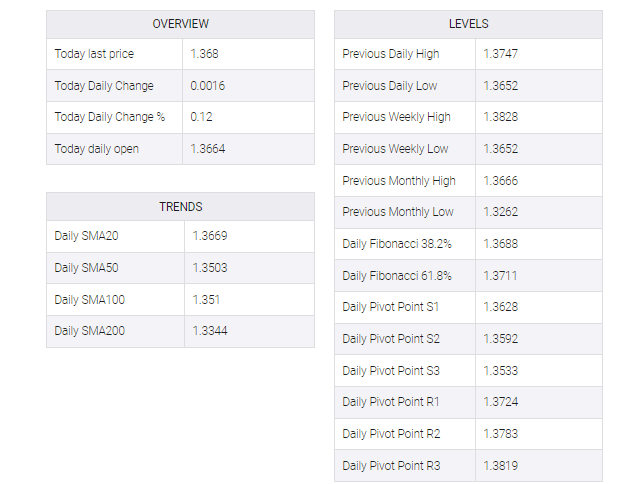

The USD/CAD pair attracts some buying in the vicinity of the 1.3650 region on Tuesday and stick to its modest intraday gains through the early part of the European session. Spot prices, however, struggle to capitalize on the move and retreat a few pips from the 1.3700 neighborhood, or a fresh daily high touched in the last hour.

Crude oil prices came under some renewed selling pressure and rose above a 15-month low touched earlier in the day amid concerns that a deepening global economic slowdown will dampen fuel demand. As a result, this appears to weaken the commodity-linked loonie, which acts as a tailwind for the USD/CAD pair with the US dollar recovering from the lowest levels since February 14. That said, the combination of factors puts a lid on any meaningful upside for Bucks and Chiefs, at least for now.

The news that UBS will rescue Credit Suisse in a $3.24 billion deal helped ease fears of widespread contagion risks and boost investor confidence, evident from the generally positive tone around equity markets. In addition, the Federal Reserve (Fed) is expected to soften its hawkish stance to prevent any further economic pressure from higher borrowing costs, further contributing to capping the safe-haven greenback. In fact, current market prices indicate a greater possibility of a 25 bps Fed rate hike in March.

Market participants expect the US central bank to cut rates in the second half of the year. The speculation was fueled by the collapse of two mid-sized US banks – Silicon Valley Bank and Signature Bank. This, in turn, should act as a headwind for US bond yields and prevent traders from placing aggressive bullish bets ahead of key central bank event risks. The Fed will announce its monetary policy decision at the end of its two-day meeting on Wednesday and boost USD demand.

Meanwhile, traders on Tuesday will take cues from the release of the latest Canadian consumer inflation figures later in the first North American session. The data, along with oil price dynamics, will impact the Canadian dollar and provide some impetus to the USD/CAD pair. In addition, the US economic docket – consisting of existing home sales data – will also be looked at to capture short-term opportunities.