-

EUR/GBP has gauged an intermediate cushion around 0.8810 as BoE claims rapid inflation softening ahead.

-

The BoE announced a 25 bps rate hike and pushed rates to 4.25% despite fears of a banking crisis.

-

ECB Knot is in favor of further rate hikes in May as inflation is showing no signs of abating.

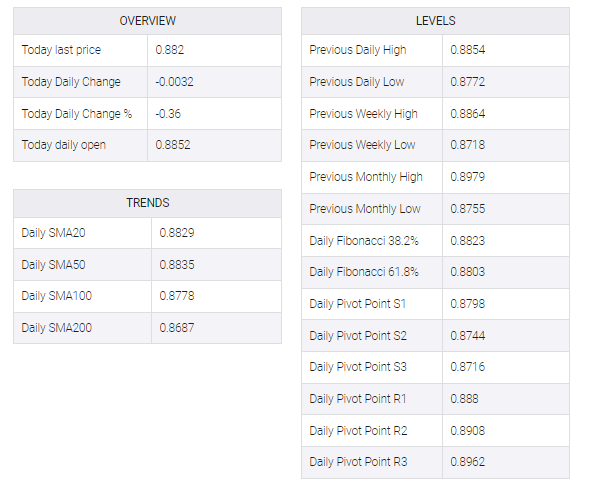

The EUR/GBP pair found an intermediate cushion around 0.8810 early in the Tokyo session. Earlier, cross selling was witnessed after the Bank of England (BoE) announced an eleventh consecutive rate hike to sharpen its tools in the fight against double-digit inflation. BoE Governor Andrew Bailey announced a rate hike by 25 basis points (bps), pushing rates to 4.25%.

The asset is expected to offer more weakness going forward as the street believes that United Kingdom (UK) inflation is very stubborn and will take a lot of time to get under control. The BoE has gone too far with rate hikes to 4.25% and with annual inflation still in double-digits, there is no sign of softening ahead.

On Wednesday, the UK Office for National Statistics headline Consumer Price Index (CPI) posted a surprise jump to 10.4% while the Street was expecting a decline to 9.8%. The BoE said the surprise rise was mainly due to less frequent volatility in clothing prices, which would not last long.

The central bank is very confident that inflation will start coming down faster from the second quarter. However, labor shortages and high food prices may keep inflation at high levels. For further guidance, investors will focus on retail sales data, which is expected to contract by 4.7% on an annual basis.

On the eurozone front, European Central Bank (ECB) policymaker Claes Knott said the ECB’s rate hike was unlikely and added that it still thinks it needs to raise policy rates in May. Investors should be aware that the ECB raised rates by 50 bps last week. Of course, more rate hikes are certainly in the pipeline as ECB President Christine Lagarde has been reiterating that high inflation will persist for a long time.