-

EUR/USD is set to finish the week with decent gains of 0.89%.

-

US economic data was mixed, though it portrays a deceleration of the economy.

-

ECB policymakers remain focused on tackling high inflation levels in the Eurozone.

As the New York session finished, EUR/USD fell 0.64% or 69 pips. A risk-on impulse did not help the Euro (EUR), which, pressured by a banking crisis threatening to spread to the Eurozone, weakened the shared currency. At the time of writing, the EUR/USD is trading at 1.0759.

EUR/USD drops on US Dollar strength, weak EU PMIs

Despite facing another bout of volatility, the US stock market is poised to end the week on a positive note. Deutsche Bank stock suffered a sharp decline on concerns about the possibility of default reflected in a 220 basis point increase in credit default swaps (CDS). While this hurt Wall Street earlier in the session, investors appeared to dismiss these fears and instead assumed the Federal Reserve (Fed) would cut interest rates in 2023.

Wall Street ended the week with gains. Deutsche Bank stock suffered a sharp decline amid concerns that the bank could default, evidenced by a 220 basis point rise in credit default swaps (CDS). While this initially caused some concern on Wall Street, investors ultimately dismissed these fears, speculating that the Federal Reserve (Fed) will cut interest rates in 2023.

St. Louis Fed President James Bullard indicated that rates should be raised further to reach the 5.50%-5.75% range, which would mean an additional 75 bps rate hike on top of the Fed’s recent hike of 4.75%-5.00%. Meanwhile, Atlanta Fed President Raphael Bostic commented that the decision made in March was not easy, as there was a lot of controversy and it was not an easy choice.

Thomas Barkin, president of the Richmond Federal Reserve, said he felt the banking sector was very stable when they reached the meeting. Therefore the conditions were favorable for the implementation of monetary policy as intended.

The S&P global PMI showed improvement in March, beating both expectations and data from the previous month. While the manufacturing index remained in contraction mode, durable good orders fell 1%, which was still an improvement over the previous month’s reading.

In the euro area (EU), March’s S&P global PMI was positive, except for the manufacturing component, which remained in recessionary territory. European Central Bank (ECB) policymakers crossed the news wires, led by ECB President Christine Lagarde, saying there was no trade-off between prices and financial stability.

Bundesbank President Joachim Nagel commented that a break was not right as inflation, which averaged around 6% in the euro zone’s largest economy, Germany, would take too long to return to the ECB’s 2% target. “Wage growth is likely to be prolonged during periods of high inflation,” Nagel said in Edinburgh. “In other words: inflation will be more permanent.”

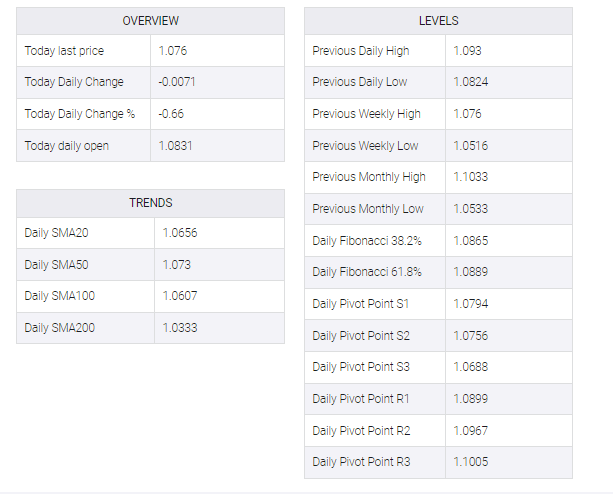

EUR/USD Technical analysis

The EUR/USD failed to hold to its previous gains, though the triple bottom chart pattern remains in play as long as it stays above 1.0759. A breach of the latter would invalidate the pattern, and open the door for further losses. On the upside, the first resistance would be 1.0800, followed by the 1.0900 figure, ahead of the YTD high at 1.1032.