-

USD/CHF regains positive traction on Tuesday and reverses a major part of the overnight losses.

-

A generally positive risk tone undermines the safe-haven CHF and lends support to the major.

-

The Fed’s less hawkish outlook keeps the USD bulls on the defensive and might cap the upside.

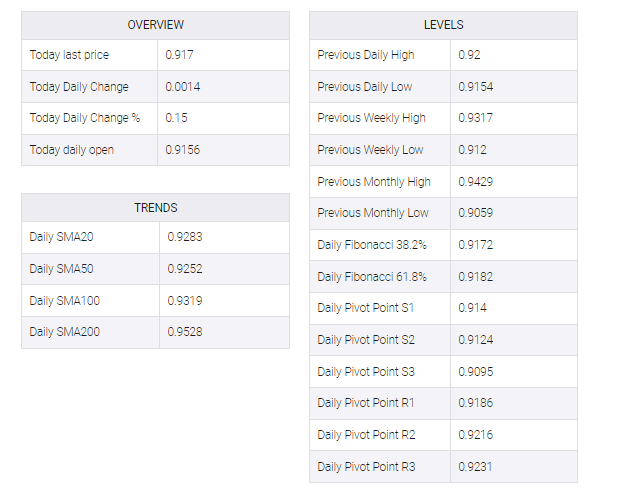

The USD/CHF pair attracted some buyers near the 0.9135 region on Tuesday and spiked to fresh daily highs at the start of the European session. The pair is currently held near the 0.9180 area and has now reversed a large portion of the previous day’s losses.

Reduced fears of a full-blown banking crisis supported a generally positive risk tone, which, in turn, weakened the safe-haven Swiss franc (CHF) and pushed the USD/CHF pair higher. First Citizens Bank & Trust Co.’s acquisition of Silicon Valley Bank calmed market nerves about contagion risks. Moreover, regulators’ assurances that they are prepared to deal with any liquidity shortages have helped reverse recent negative sentiment and increased investor appetite for perceived riskier assets.

The US Dollar (USD), on the other hand, remains under some selling pressure for the second day in a row and may prevent traders from placing aggressive bullish bets around the USD/CHF pair. The USD continues to be unbalanced as the Federal Reserve eases its approach to rein in inflation. This, with a modest decline in the yield of US Treasury bonds, turned out to be another factor before the position for more complimentary actions for the deer and warrant caution major.

Market participants now look to Tuesday’s US economic docket – featuring the Conference Board’s Consumer Confidence Index and the Richmond Manufacturing Index. Apart from this, the US bond yields, might influence the USD price dynamics and provide some impetus to the USD/CHF pair. Traders will further take cues from the broader risk sentiment to grab short-term opportunities. The focus, however, will remain on the release of the Fed’s preferred inflation gauge – the US Core PCE Price Index on Friday.