-

USD/CAD stages a goodish rebound from a multi-week low amid a pickup in the USD demand.

-

Bullish Crude Oil prices underpin the Loonie and act as a headwind amid a positive risk tone.

-

Traders also seem reluctant to place bets ahead of the Canadian GDP and the US PCE inflation.

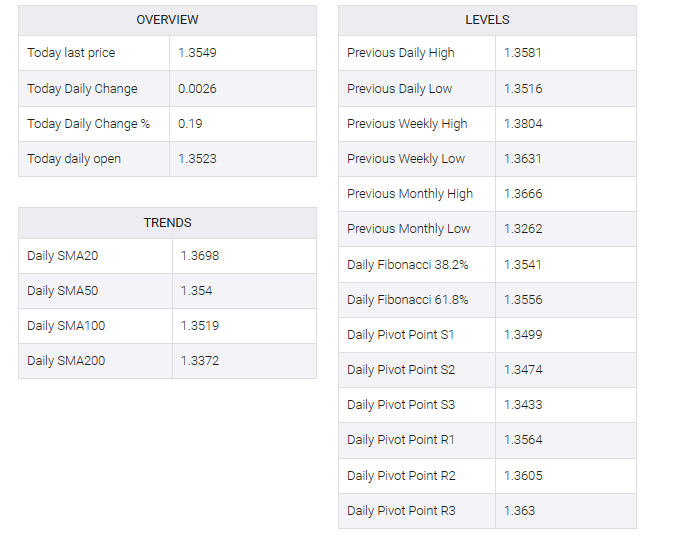

The USD/CAD pair showed resilience below the 100-day simple moving average (SMA) and attracted some buying near the 1.3500 psychological mark, or the five-and-a-half-week low touched early on Friday. The pair maintained its bid tone heading into the North American session and is currently held near the 1.3550 area, just a few pips below the daily high.

The USD dollar (USD) regained some positive traction in the last day of the week and is seen as a key factor acting as a tailwind for the USD/CAD pair. That said, the prevailing risk-on sentiment puts a lid on any meaningful upside for the safe-haven greenback. Beyond that, the recent surge in crude oil prices, near three-week highs, gave some support to the commodity-linked loonie and contributed to profit capping for the major.

Traders appear reluctant to make aggressive bets ahead of the release of monthly Canadian GDP and the US core PCE price index, the Fed’s preferred inflation gauge. The USD/CAD pair, for now, appears to have stalled its intraday positive move near the 50% Fibonacci retracement level of the February-March rally. A sustained move beyond this could lift the spot price above the 1.3600 mark towards the 1.3640 region or 61.8% Fibo. layer

Some follow-through buying from the 1.3600 mids will negate any near-term bearish bias and pave the way for a move towards the 1.3700 round figure en route to the 1.3720 zone or 23.6% Fibo. layer

On the flip side, the 1.3500 mark represents the 61.8% Fibo. level and should now act as a major point, which if broken will be seen as a new trigger for bearish traders. The USD/CAD pair could then weaken to accelerate the decline towards intermediate support near the 1.3455-1.3450 horizontal zone. Spot prices may eventually drop to the 1.3400 round figure on the way to the next relevant support near the 1.3330-1.3325 region.