-

USD/CHF picks up bids to extend the previous day’s rebound from 22-month low.

-

Upside break of weekly resistance line, looming bull cross on MACD favor Swiss Franc sellers.

-

Two-month-old previous support line appears crucial for USD/CHF bulls; 100-SMA acts as the last defense of bears.

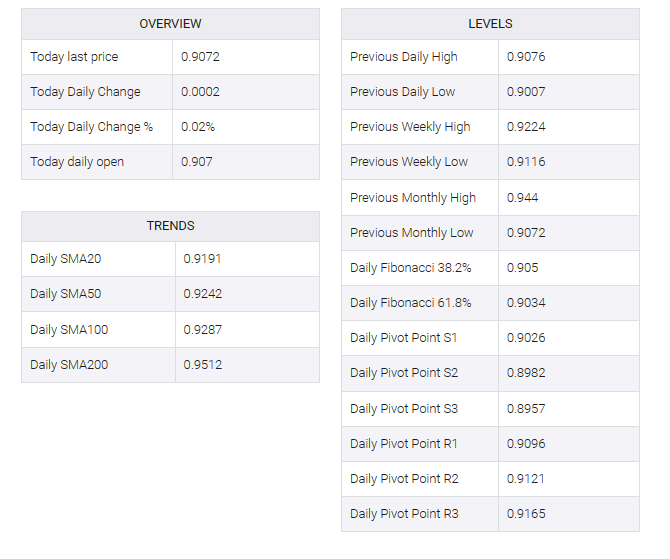

USD/CHF lured buyers near 0.9075 as it pierced a downward sloping resistance line from Monday early Thursday in Europe. In doing so, the Swiss Franc (CHF) pair extended the previous day’s recovery move from the lowest level since June 2021 in a sluggish session.

That said, a clear upside break of the immediate resistance line joins an impending bull cross on the MACD to tempt USD/CHF buyers. However, the previous support line from early February, around 0.9080 by press time, challenges the quote’s recovery.

If the USD/CHF pair remains firmer after 0.9080, a one-month-old resistance line, near 0.9155, acts as the pair’s sellers’ last defense before the 100-SMA level near 0.9190.

In a case where the quote rises above 0.9190 and also crosses the 0.9200 round figure, it can target the mid-March high of 0.9342.

Meanwhile, the immediate resistance-turned-support line near 0.9070 restricts the immediate downside of the USD/CHF price ahead of the latest bottom surrounding 0.9005. Also acting as a downside filter is the 0.9000 psychological magnet, a break of which could drag the pair toward June 2021 low surrounding 0.8925.

Overall, USD/CHF is likely to consolidate recent losses near the multi-month low but the bullish trend is far from sight.

USD/CHF: Four-hour chart

Trend: Further recovery expected