-

NZD/USD stages a modest bounce from a nearly four-week low touched earlier this Wednesday.

-

A modest USD weakness lends some support, though looming recession risks act as a headwind.

-

Investors also seem reluctant ahead of the crucial US CPI report and the FOMC meeting minutes.

The NZD/USD pair rebounded from a near four-week low on Peters this Wednesday and continued to trade below the 0.6200 mark at the start of the European session.

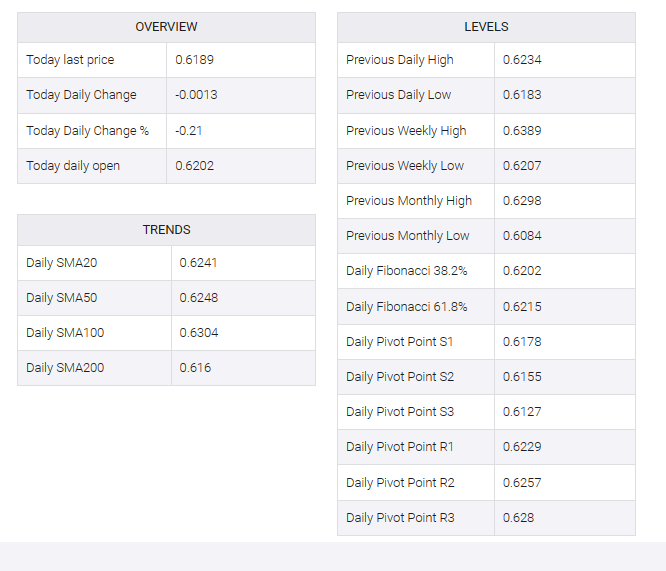

The US dollar (USD) is closing in on weekly lows amid growing acceptance that the Federal Reserve (Fed) is nearing the end of its rate-hiking cycle, helping the NZD/USD pair attract some buying at the mid-decade level of 0.6100. Traders, meanwhile, are still pricing in a greater possibility of a 25 bps lift-off at the next FOMC meeting in May. That puts a floor below US Treasury bond yields for now, acting as a tailwind for the greenback.

In addition, concerns of a deeper global economic slowdown provide some support to safe havens and contribute to capping risk-sensitive qi. Indeed, the International Monetary Fund (IMF) on Tuesday trimmed its 2023 global growth outlook, citing the impact of higher interest rates. Moreover, Minneapolis Fed President Neil Kashkari warned that tightening credit conditions due to monetary policy actions could lead to a recession.

Traders also appear reluctant to place aggressive directional bets and prefer to sideline ahead of US consumer inflation figures, due later in the first session in North America. This will be followed by FOMC meeting minutes, which will be watched for clues about the Fed’s rate-hike path. Key releases will play an important role in influencing near-term USD price dynamics and determining the next phase of a directional move for the NZD/USD pair.

From a technical perspective, acceptance below the 0.6200 round figure could be seen as a fresh trigger for bearish traders and supports prospects for further losses. That said, the emergence of some buying at lower levels warrants some caution. This mixed technical setup makes it prudent to wait for some follow-through buying before confirming that the recent pullback from the 0.6380 area, or the highest level since February 14 has run its course and positioning for any further gains.