-

USD/CHF faces resistance at 0.9000 and falls for the first time in three days.

-

USD/CHF Price Analysis: It could print a leg-up above 0.9000; Otherwise, a bearish continuation will resume below 0.8900.

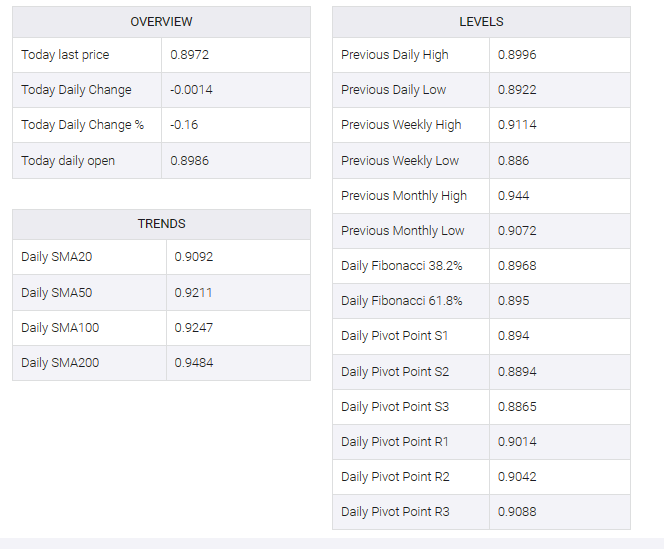

USD/CHF retreats after posting back-to-back days of gains, down 0.17%, after hitting a weekly high of 0.8996. At the time of writing, the USD/CHF exchanges hands at 0.8969, ahead of the Wall Street close.

USD/CHF Price Action

From a technical perspective, the USD/CHF daily chart portrays the main bearish bias, losing around 3% annually. However, last Friday, the USD/CHF pair suffered a three-day losing streak, forming a bullish piercing pattern that failed to extend above the psychological 0.9000 figure. Although USD/CHF is in a pullback, the Rate of Change (RoC) suggests that buyers are outpacing sellers, which could play a challenge to the 0.9000 mark.

If USD/CHF cracks next, it will reveal the 20-day exponential moving average (EMA) at 0.9065, followed by the 0.9100 mark. Once cleared, USD/CHF could move towards the 50-day EMA at 0.9164.

Conversely, a bearish continuation would resume if USD/CHF breaks below 0.8921. A breach of the latter would reveal the 0.8900 figure, followed by a YTD low at 0.8859.