-

USD/CHF is expected to extend the downside to near 0.8900 amid weak appeal for the USD Index as safe-haven.

-

A consecutive 25 bps interest rate hike is expected to be followed by neutral guidance from the Fed.

-

US yields are under immense pressure after Treasury estimated that it would be out of funds for payments by early June.

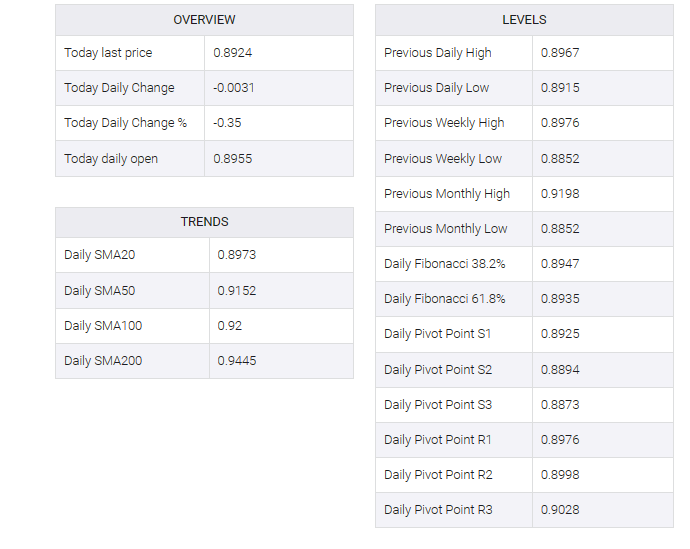

The USD/CHF pair is struggling to defend the immediate support of 0.8920 early in the Asian session. The Swiss franc asset faced heavy selling pressure after a steep dive in the US dollar index (DXY). The major is expected to decline further towards the round-level support of 0.8900 as debt-ceiling concerns dim the USD index’s appeal as a safe haven.

S&P500 futures fell in Asia after Tuesday’s decline. Investors dumped US equities amid uncertainty over the Federal Reserve’s (Fed) interest rate policy. Also, market sentiment is quite risk-averse as raising the debt ceiling will affect the long-term outlook for the US economy.

US Treasury yields are under severe pressure after US Treasury Secretary Janet Yellen estimated that the Treasury will run out of money for payments as early as June. Concerns about the debt ceiling flared up after US President Joe Biden showed reluctance to meet with US Senate McCarthy as House Republicans opposed raising the debt limit and demanded big cuts to the president’s spending initiative. At the time of writing, the 10-year US Treasury yield has dipped to around 3.43%.

Fed Chair Jerome Powell is expected to raise interest rates by 25 basis points (bps) to 5.00-5.25%, according to the CME Fedwatch tool. A consecutive 25 bps interest rate hike is expected to be followed by neutral guidance as the US manufacturing PMI continues to show contraction, growth has slowed, and labor market conditions are losing resilience.

On the Swiss franc front, Friday’s inflation data (April) will be closely watched. The monthly Consumer Price Index (CPI) is expected to accelerate to a faster pace of 0.5% from the previous recording of 0.2%. However, the annual CPI is expected to soften to 2.8% versus the previous release of 2.9%.