-

GBP/USD holds lower grounds after breaking key supports and snapping two-week uptrend.

-

Bearish MACD signals, steady RSI line keeps Cable bears hopeful.

-

50-DMA can prod the Pound Sterling sellers before horizontal area comprising levels marked since late March.

-

21-DMA adds strength to 1.2510 immediate resistance, bulls need validation from 1.2600 to retake control.

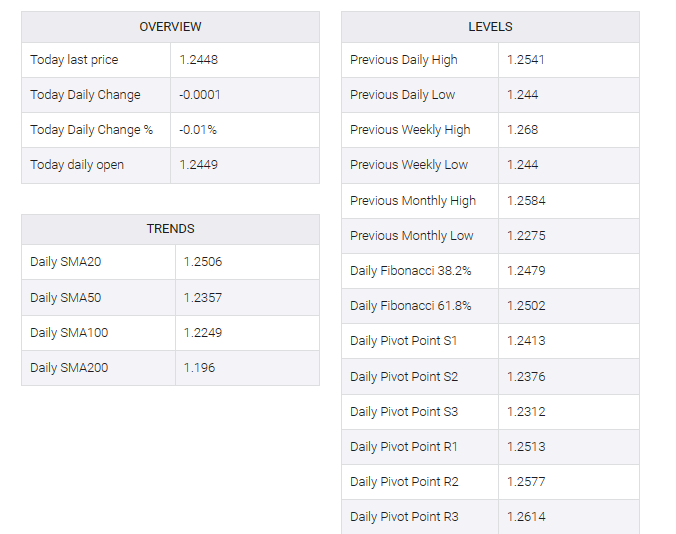

GBP/USD remained under mid-decade pressure at 1.2400 early Monday, after posting its biggest weekly loss since late January. In doing so, the cable pair remains on the bear’s radar as it remains below the key support line, now resisting in the absence of a price-positive oscillator.

That said, bearish signals from the MACD and a steady RSI (14) only allow the bears to extend the previous week’s downward break of the key support line extended from March. Also keeping GBP/USD optimistic is the quote’s sustained trading below the 21-DMA.

With this, Pound Sterling looks well set for a further decline towards the 50-DMA support near 1.2375.

However, in late March, a horizontal zone containing multiple levels marked from around 1.2340, appears to be a tough nut to crack for GBP/USD bears later, which if broken would hesitate to pull the quote towards the early March high and integrated 1.2200 support. no Low in late March.

Conversely, the 21-DMA and an upward-sloping trend line from March 24, last around 1.2510, limit the GBP/USD pair’s immediate recovery.

Next, a two-month-old support-bend-resistance line near 1.2600 will serve as a break that allows the pound sterling bulls to regain control.

GBP/USD: Daily chart

Trend: Further downside expected