- EUR/USD has stretched its rebound move above 1.0780 amid a sluggish performance by the USD Index.

- Federal Reserve Powell favored a pause in the rate-hiking spell amid tight credit conditions by US regional banks.

- European Central Bank Lagarde is expected to throw some light on June’s monetary policy.

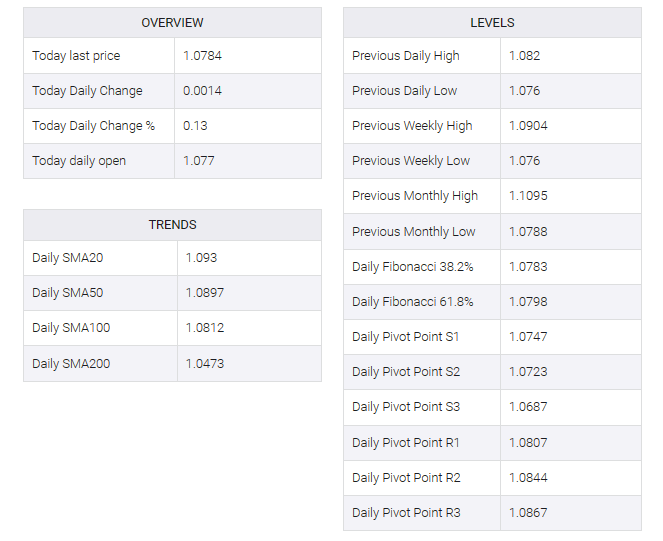

- EUR/USD is oscillating inside the 50% and 61.8% Fibonacci retracements plotted at 1.0806 and 1.0738 respectively.

EUR/USD further extended its recovery above the immediate resistance of 1.0780 in the early European session. Major currency pairs gained some traction as the US Dollar Index (DXY) balanced below 103.50. Earlier, the shared currency pair rebounded after falling near 1.0760 as the USD index faced stiff resistance to extend its upward rally above the previous week’s high of 103.62.

S&P500 futures managed to hold on to gains added to Asia and advanced further in early London, depicting a slight recovery in market participants’ risk appetite. US indices witnessed a sharp sell-off on Tuesday as investors eased positions in technology stocks Investors are worried that US President Joe Biden’s delayed response to the US debt-ceiling issue has raised fears of a default by the federal government.

Broadly, the US dollar index is showing signs of narrowing volatility below 103.60 as investors await the release of Federal Open Market Committee (FOMC) minutes for the May monetary policy meeting.

Fears of a catastrophic US default deepen

Fears of investors that the United States economy would announce a default after June 01 while addressing its obligated payments are deepening. US House Speaker Kevin McCarthy told House Republicans during a closed GOP meeting on Tuesday that “I need you all to hang with me on the debt limit, we are nowhere near a deal yet,” This indicates that expectations of a bipartisan by Republicans with the White House are losing its spirit.

No fresh commentary from US President Joe Biden over the agreement of a rise in US borrowing cap is making the market participants extremely anxious. US Treasury Secretary is continuously warning that the Federal will be out of funds by June 01, which would cause the loss of millions of jobs domestically. Also, it will bring chaos in global financial markets and would lead to a spike in interest rates.

FOMC minutes to remain in spotlight

For making a decisive action, investors are awaiting the release of the FOMC minutes. The minutes for May’s monetary policy meeting are expected to provide a detailed explanation behind the 25 basis points (bps) interest rate hike by the Federal Reserve (Fed). Also, it will provide current economic prospects and guidance about interest rates.

However, Federal Reserve chair Jerome Powell in a meeting on Friday favored a pause in the rate-hiking spell as tight credit conditions by US regional banks have squeezed the flow of credit into the economy. Firms are facing working capital issues due to the enrolment of more filters by US banks, which could force them to underutilize their entire capacity.

European Central Bank President Christine Lagarde’s speech in focus

A power-pack action was delivered by the Euro remained on Tuesday after the release of mixed preliminary May PMI data. Manufacturing PMI contracted to 44.6 from the estimates of 46.2 and the former release of 45.8. A figure below 50.0 is measured as a contraction in manufacturing activities. While Services PMI jumped to 55.9 vs. the consensus of 55.6 but remained lower than the prior release of 56.2. Analysts at Commerzbank expect a slight decline in real GDP in the second half of the year.

On Wednesday, the speech from European Central Bank (ECB) President Christine Lagarde will be keenly watched. European Central Bank Lagarde is expected to throw some light on June’s monetary policy as she already announced that more than one interest rate hikes are appropriate to tame stubborn Eurozone inflation.

EUR/USD technical outlook

EUR/USD is oscillating inside the 50% and 61.8% Fibonacci retracements (plotted from March 15 low at 1.0516 to April 26 high at 1.1095) at 1.0806 and 1.0738 respectively on a four-hour scale. The 20-period Exponential Moving Average (EMA) at 1.0796 is acting as a strong barrier for the Euro bulls. The major currency pair has attempted a recovery move after finding strength near the immediate support plotted around 1.0760.

The Relative Strength Index (RSI) (14) is attempting a range shift move into the 40.00-60.00 zone from the bearish territory of 20.00-40.00, which indicates that the downside momentum has faded for now.